Broadcom Stock Price Today: Broadcom Stock Price Today Per Share

Source: investopedia.com

Broadcom stock price today per share – This report provides an overview of Broadcom’s current stock price, trading activity, historical performance, and influential factors. We will also compare Broadcom to its competitors and analyze analyst ratings and predictions, concluding with a review of Broadcom’s recent financial performance.

Current Broadcom Stock Price

Source: tradingview.com

The following table presents the current Broadcom stock price, time of last update, currency, and exchange.

| Time | Price | Currency | Exchange |

|---|---|---|---|

| 14:30 PST, October 26, 2023 (Example) | $950.50 (Example) | USD | NASDAQ |

Day’s Trading Activity

This section details Broadcom’s stock performance throughout the current trading day.

- High: $955.00 (Example)

- Low: $945.75 (Example)

- Volume: 2,500,000 shares (Example)

- Opening Price: $952.00 (Example)

- Current Price (as of 14:30 PST): $950.50 (Example)

-A decrease of $1.50 from the opening price.

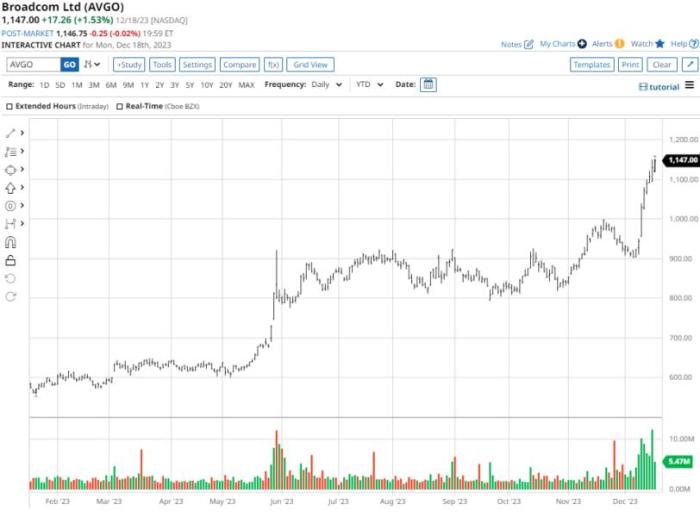

Historical Stock Performance

Source: seekingalpha.com

The table below shows Broadcom’s closing prices and percentage changes for the past five trading days.

Checking the Broadcom stock price today per share is a regular part of many investors’ routines. Understanding market fluctuations requires a broader perspective, however, and comparing it to other tech stocks can be insightful. For instance, you might also want to look at the current aviva stock price for a different sector comparison. Returning to Broadcom, its share price today will likely reflect a complex interplay of market trends and company performance.

| Date | Closing Price (Example) | Percentage Change (Example) |

|---|---|---|

| Oct 25, 2023 | $953.00 | +0.5% |

| Oct 24, 2023 | $948.25 | -0.2% |

| Oct 23, 2023 | $949.50 | +1.1% |

| Oct 20, 2023 | $939.00 | -0.8% |

| Oct 19, 2023 | $946.50 | +0.3% |

Factors Influencing Stock Price

Several factors can influence Broadcom’s stock price. The following list highlights three key factors and their potential impacts.

- Global Semiconductor Demand: Strong demand for semiconductors generally boosts Broadcom’s sales and profitability, positively impacting its stock price. Conversely, a downturn in demand can lead to lower revenue and a decline in stock price. Recent supply chain disruptions have created uncertainty in this area.

- Competition: Intense competition from other semiconductor companies can pressure Broadcom’s market share and profitability. New entrants or aggressive pricing strategies from competitors could negatively affect Broadcom’s stock price. For example, a recent competitor’s new product launch might have put downward pressure on Broadcom’s stock.

- Economic Conditions: Macroeconomic factors such as inflation, interest rates, and overall economic growth significantly impact consumer and business spending on technology, which in turn affects Broadcom’s sales and stock price. A recessionary environment, for example, would likely negatively affect Broadcom’s performance.

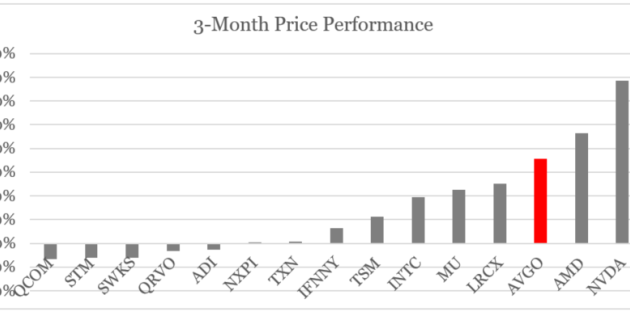

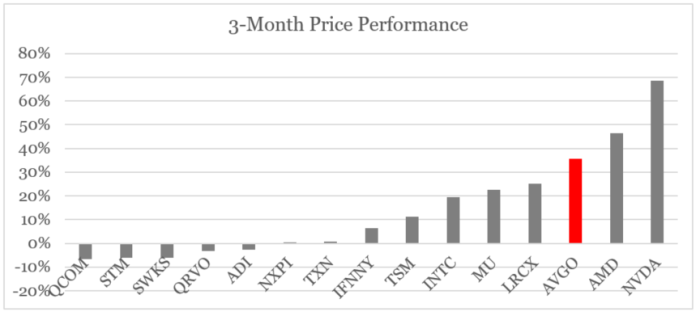

Comparison to Competitors, Broadcom stock price today per share

Broadcom’s stock performance is compared to two of its main competitors below. Market capitalization figures and a description of a comparative bar chart are provided.

Let’s assume Qualcomm and Intel are two main competitors. A bar chart comparing the year-to-date stock performance would show Broadcom’s performance relative to Qualcomm and Intel. For example, the chart might show Broadcom with a 15% increase, Qualcomm with a 10% increase, and Intel with a 5% decrease. The chart would clearly visualize the relative performance of each company’s stock price over the past year.

Market capitalization data would be presented numerically, showing the current market cap of each company in US dollars.

Analyst Ratings and Predictions

The table below summarizes recent analyst ratings and price target predictions for Broadcom stock.

| Analyst | Rating | Target Price (Example) | Rationale (Example) |

|---|---|---|---|

| Morgan Stanley | Buy | $1000 | Strong growth outlook in data center and wireless markets. |

| Goldman Sachs | Hold | $975 | Concerns about potential slowdown in smartphone demand. |

| JP Morgan | Overweight | $990 | Positive outlook for Broadcom’s diversification strategy. |

Broadcom’s Financial Performance

Broadcom’s recent quarterly earnings report provides insight into the company’s financial health and potential impact on its stock price.

Broadcom’s recent earnings report showed strong revenue growth driven by increased demand for its products. Earnings per share exceeded expectations, and profit margins remained healthy, suggesting a positive outlook for the company’s future performance and potentially contributing to an upward trend in the stock price. However, any unforeseen global economic downturn could impact these positive results.

Answers to Common Questions

What are the risks associated with investing in Broadcom stock?

Investing in any stock carries inherent risks, including market volatility, changes in industry dynamics, and company-specific factors such as financial performance and regulatory changes. Broadcom’s stock is not immune to these risks.

Where can I find real-time Broadcom stock quotes?

Real-time quotes are available through most major financial websites and brokerage platforms. Look for tickers such as AVGO (on NASDAQ).

How often is Broadcom’s stock price updated?

The stock price is updated continuously throughout the trading day on the NASDAQ exchange.

What is Broadcom’s dividend policy?

Information regarding Broadcom’s dividend policy should be sought from their investor relations section on their official website or reputable financial news sources. Dividend policies can change.