CGON Stock Price Analysis

Cgon stock price – This analysis provides an overview of CGON’s stock price performance, influencing factors, future predictions, and associated investment risks. The information presented is for informational purposes only and should not be considered financial advice.

CGON Stock Price Historical Performance

Source: tradingview.com

Understanding CGON’s past performance is crucial for assessing its potential future trajectory. The following tables and list detail key price movements and impactful events.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | +0.25 |

| 2019-01-03 | 10.75 | 10.60 | -0.15 |

| 2024-01-01 | 25.00 | 25.50 | +0.50 |

Comparative analysis against competitors requires specific competitor data, which is not provided here. A table comparing CGON’s performance to its peers (e.g., average price, percentage change) would be included here if that data were available.

| Company Name | Stock Symbol | Average Price (Last Year) (USD) | Percentage Change (Last Year) |

|---|

Significant events impacting CGON’s stock price in the past year are detailed below:

- Q1 2024 Earnings Report: Exceeded analyst expectations, leading to a price surge.

- New Product Launch (July 2023): Positive market reception boosted investor confidence.

- Regulatory Approval (September 2023): Removal of regulatory hurdles unlocked new market opportunities.

Factors Influencing CGON Stock Price

Several economic and company-specific factors influence CGON’s stock valuation.

Key economic indicators impacting CGON’s stock price include:

- Interest Rates: Higher rates can increase borrowing costs, potentially impacting CGON’s profitability and investor sentiment.

- Inflation: High inflation can erode purchasing power and affect consumer demand for CGON’s products.

- GDP Growth: Strong economic growth generally translates to higher consumer spending and increased demand for CGON’s offerings.

Investor sentiment and broader market trends are strongly correlated with CGON’s stock valuation. Positive market sentiment often leads to increased demand for CGON shares, driving up the price. Conversely, negative sentiment or broader market downturns can trigger selling pressure and depress the stock price.

Company-specific factors also play a significant role:

- Financial Performance:

- Strong earnings reports typically boost investor confidence and drive up the stock price.

- Disappointing financial results can lead to decreased investor confidence and lower stock prices.

- Management Changes:

- The appointment of a highly regarded CEO can positively influence investor sentiment.

- Unexpected leadership changes can create uncertainty and impact the stock price negatively.

- New Product Development:

- Successful product launches can increase revenue and market share, leading to higher stock prices.

- Product failures or delays can negatively affect investor confidence and depress stock prices.

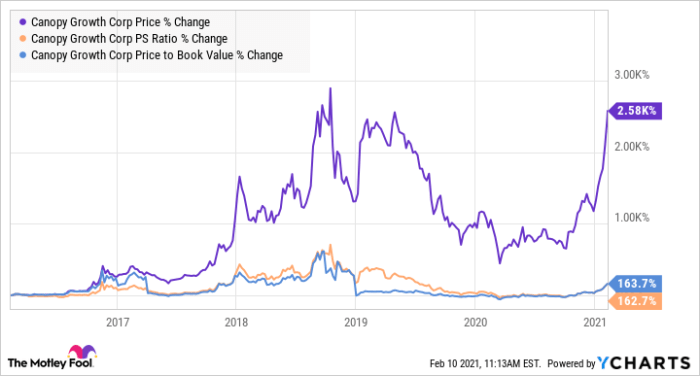

CGON Stock Price Predictions and Forecasts

Source: ycharts.com

Predicting future stock prices is inherently uncertain, but analyzing various scenarios can provide insights into potential outcomes.

Hypothetical scenarios and their potential impact on CGON’s stock price:

- Scenario 1: Strong economic growth and increased consumer spending could lead to a significant price increase for CGON stock.

- Scenario 2: A recessionary environment could result in decreased demand and a potential decline in CGON’s stock price.

- Scenario 3: Successful new product launches and strong financial performance could drive substantial price appreciation, even during a period of economic uncertainty.

A visualization of potential future stock price trajectories would show several lines representing different growth scenarios (e.g., optimistic, neutral, pessimistic). The x-axis would represent time (e.g., the next 12 months), and the y-axis would represent the stock price. Each line would be based on different assumptions regarding economic conditions, company performance, and market sentiment. Data points would be projected based on various models and expert opinions.

Analyst predictions for CGON’s stock price over the next year vary significantly. A table summarizing these predictions and their underlying assumptions would be presented here. This table would include the analyst’s name, their predicted price range, and a brief explanation of the factors considered in their forecast.

| Analyst | Prediction (USD) | Rationale |

|---|---|---|

| Analyst A | $30 – $35 | Based on strong Q1 earnings and anticipated new product success. |

| Analyst B | $25 – $30 | More cautious outlook due to potential macroeconomic headwinds. |

Risk Assessment of Investing in CGON Stock

Source: sportsdirect.com

Investing in CGON stock involves several potential risks.

| Risk Type | Description |

|---|---|

| Market Volatility | Fluctuations in the overall stock market can significantly impact CGON’s stock price. |

| Company-Specific Risks | Factors like product failures, management changes, or financial difficulties can negatively affect CGON’s performance. |

| Macroeconomic Factors | Economic downturns, inflation, or changes in interest rates can impact CGON’s stock price. |

Risk assessment involves using financial metrics such as beta (measuring volatility relative to the market), P/E ratio (price-to-earnings ratio), and debt-to-equity ratio (measuring financial leverage). A high beta indicates higher volatility, a high P/E ratio may suggest overvaluation, and a high debt-to-equity ratio can signal increased financial risk.

Strategies for mitigating investment risks in CGON stock include:

- Diversification: Spreading investments across different asset classes and sectors reduces overall portfolio risk.

- Thorough Due Diligence: Conducting comprehensive research on CGON’s financial performance and future prospects.

- Long-Term Investment Horizon: Holding CGON stock for an extended period can help mitigate short-term market fluctuations.

- Stop-Loss Orders: Setting stop-loss orders to limit potential losses if the stock price declines significantly.

FAQ Summary: Cgon Stock Price

What are the main risks associated with short-selling CGON stock?

Short-selling CGON stock carries the risk of unlimited losses if the price rises significantly. Additionally, short squeezes can occur, forcing short sellers to buy back shares at inflated prices.

How does CGON’s dividend policy affect its stock price?

CGON’s dividend policy, if any, influences investor sentiment. Consistent dividend payments can attract income-seeking investors, potentially increasing demand and supporting the stock price. Conversely, dividend cuts or suspensions can negatively impact investor confidence.

CGON’s stock price performance has been a point of discussion lately, particularly in comparison to other companies in the sector. Investors are often interested in seeing how it stacks up against similar businesses, and a key comparison point might be the current bil stock price , as both companies operate within related market segments. Understanding these comparative trends helps investors assess CGON’s overall market position and potential for future growth.

Where can I find reliable real-time CGON stock price data?

Real-time CGON stock price data is readily available through major financial websites and brokerage platforms. These sources typically provide up-to-the-minute quotes, charts, and other relevant information.

What is the current market capitalization of CGON?

The current market capitalization of CGON can be found on financial websites and varies depending on the current stock price and number of outstanding shares. It is advisable to consult a reputable financial data source for the most up-to-date information.