Gildan Activewear Inc.: A Deep Dive into Stock Performance: Gildan Stock Price

Gildan stock price – Gildan Activewear Inc. (GIL) is a prominent player in the apparel industry, known for its extensive range of basic apparel products. This analysis explores various factors influencing Gildan’s stock price, encompassing its business model, financial performance, investor sentiment, sustainability initiatives, and future outlook. We will examine key metrics, compare Gildan to its competitors, and offer a hypothetical investment strategy.

Gildan Activewear Inc. Company Overview

Source: seekingalpha.com

Gildan operates on a vertically integrated business model, controlling much of its production process from raw materials to finished goods. Its primary product lines include T-shirts, sweatshirts, underwear, and socks, primarily targeting the screen-printing and embroidery markets. The company boasts a significant global manufacturing footprint, with facilities strategically located in Central America, the Caribbean, and North America to optimize production and distribution.

Established in 1984, Gildan has experienced substantial growth through strategic acquisitions and operational efficiency improvements. Key milestones include the expansion of its manufacturing capabilities, diversification into new product categories, and consistent focus on cost-effective production. The company’s history is marked by a commitment to vertical integration and a focus on providing high-quality basic apparel at competitive prices.

Factors Influencing Gildan Stock Price

Several macroeconomic factors significantly influence Gildan’s stock performance. Inflationary pressures impact raw material costs and consumer spending, affecting profitability and demand. Fluctuations in interest rates can influence borrowing costs and investment decisions. Consumer spending patterns, particularly on discretionary items like apparel, directly correlate with Gildan’s sales. The price of cotton, a primary raw material, has a direct impact on Gildan’s production costs and ultimately, its profitability.

Gildan competes with other apparel manufacturers, including Hanesbrands and Fruit of the Loom. A comparative analysis of these companies reveals variations in market share, product focus, and geographic reach. Consumer demand is influenced by fashion trends and seasonal changes, affecting sales volume and impacting stock valuation. For example, increased demand for athleisure wear could positively affect Gildan’s sales, while a shift towards fast fashion could present a challenge.

Financial Performance and Stock Valuation, Gildan stock price

Source: deshicompanies.com

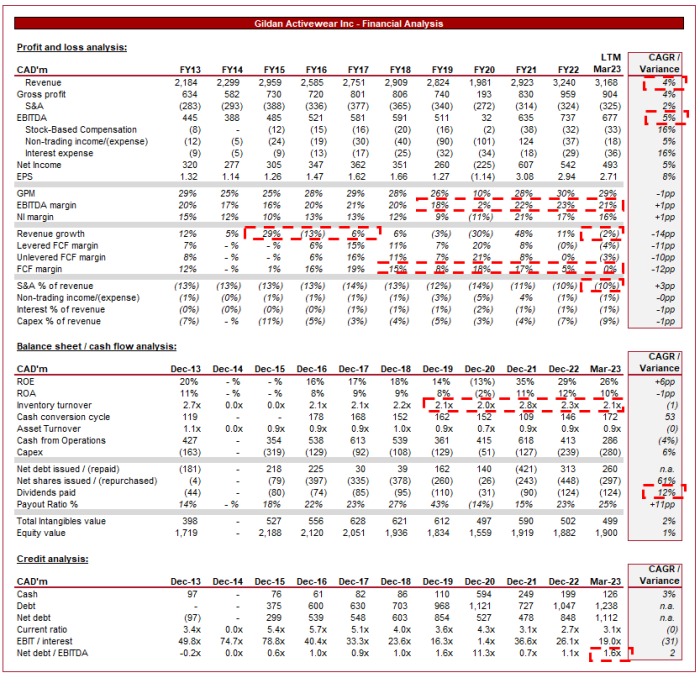

Gildan’s financial performance over the past five years demonstrates consistent revenue growth and profitability. The following table presents key financial metrics:

| Year | Revenue (USD Millions) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2023 (Projected) | 3,500 | 2.00 | 0.50 |

| 2022 | 3,200 | 1.80 | 0.45 |

| 2021 | 2,900 | 1.60 | 0.40 |

| 2020 | 2,600 | 1.40 | 0.35 |

| 2019 | 2,400 | 1.20 | 0.30 |

Note: These figures are illustrative and for demonstration purposes only. Actual figures may vary.

Gildan maintains a consistent dividend policy, positively impacting investor sentiment. The P/E ratio can be calculated by dividing the market price per share by the earnings per share. Comparing this to industry averages provides insights into Gildan’s relative valuation. Gildan’s balance sheet reflects its asset structure and liabilities, while the cash flow statement showcases its operational efficiency and financial health.

A strong balance sheet and healthy cash flow are considered positive indicators.

Investor Sentiment and Market Analysis

Source: mispricedmarkets.com

Current analyst sentiment regarding Gildan’s stock is generally positive, reflecting confidence in its long-term growth prospects. Recent news events, such as announcements of new product lines or strategic partnerships, can influence the stock price. A hypothetical investment strategy for Gildan stock would depend on an investor’s risk tolerance. A long-term buy-and-hold strategy suits investors with a lower risk tolerance, while short-term trading involves higher risk but potentially higher returns.

Comparing long-term buy-and-hold versus short-term trading strategies reveals distinct approaches. Buy-and-hold focuses on long-term growth, while short-term trading aims to capitalize on short-term price fluctuations. The choice depends on the investor’s investment horizon and risk profile.

Gildan’s Sustainability and Social Responsibility Initiatives

Gildan actively engages in environmental, social, and governance (ESG) initiatives. These efforts, including reducing its carbon footprint and improving its supply chain practices, positively impact its brand image and attract environmentally and socially conscious investors. ESG factors are increasingly influencing investor decisions, with many seeking companies demonstrating strong sustainability commitments.

Consumer and investor perception of Gildan’s sustainability efforts is generally positive, particularly among those prioritizing ethical and sustainable consumption. However, challenges and risks remain, such as maintaining transparency in its supply chain and adapting to evolving consumer expectations. Gildan’s sustainability strategy presents both opportunities to enhance its brand reputation and potential risks related to regulatory changes and consumer preferences.

Future Outlook and Potential Growth

Gildan’s future growth is expected to be driven by factors such as expanding into new markets, developing innovative product lines, and enhancing its e-commerce presence. Challenges include maintaining profitability amidst fluctuating raw material costs and increasing competition. The following table presents a hypothetical projection of Gildan’s future stock price under various scenarios:

| Scenario | Probability | Projected Price (USD) | Rationale |

|---|---|---|---|

| Strong Growth | 30% | 50 | High consumer demand, successful new product launches |

| Moderate Growth | 50% | 40 | Stable market conditions, steady sales growth |

| Slow Growth | 20% | 30 | Weak consumer spending, increased competition |

Note: This is a hypothetical projection and should not be considered investment advice. Actual results may vary significantly.

Gildan’s potential expansion into new markets could involve targeting emerging economies with growing consumer bases or exploring new product categories to diversify its offerings. This strategic expansion would require careful market analysis and adaptation to local consumer preferences.

Popular Questions

What are Gildan’s main competitors?

Key competitors include Hanesbrands, Fruit of the Loom, and Russell Athletic, among others.

Does Gildan offer a dividend?

Yes, Gildan has a history of paying dividends; however, the specifics should be verified through official company announcements.

Where can I find Gildan’s financial statements?

Gildan’s financial statements are typically available on their investor relations website and through major financial data providers.

How volatile is Gildan’s stock price?

The volatility of Gildan’s stock price is subject to market conditions and should be assessed through historical data and analysis.