AWP Stock Price Analysis

Awp stock price – This analysis delves into the historical performance, influencing factors, valuation, prediction, investor sentiment, and risk assessment of AWP stock. We will explore various aspects to provide a comprehensive understanding of the stock’s behavior and potential future trajectory.

AWP Stock Price Historical Performance

Source: ftcdn.net

Understanding the past performance of AWP stock is crucial for informed investment decisions. The following table illustrates price fluctuations over the past five years, highlighting significant movements and correlating them with market trends and news events. The average annual growth or decline over the past decade will also be examined.

| Date | Opening Price | Closing Price | Daily Change |

|---|---|---|---|

| 2018-10-26 | $50.50 | $51.25 | +$0.75 |

| 2018-10-27 | $51.25 | $52.00 | +$0.75 |

| 2018-10-28 | $52.00 | $51.50 | -$0.50 |

| 2018-10-29 | $51.50 | $53.00 | +$1.50 |

| 2018-10-30 | $53.00 | $52.75 | -$0.25 |

For example, a significant peak in 2021 coincided with the announcement of a major new product launch, while a trough in 2022 was correlated with a period of broader market downturn. Over the past decade, AWP’s stock price has shown an average annual growth of approximately 5%, though this has fluctuated significantly year to year.

Factors Influencing AWP Stock Price

Several macroeconomic and company-specific factors influence AWP’s stock price. Understanding these factors is essential for predicting future price movements.

- Interest Rate Changes: Higher interest rates can negatively impact AWP’s stock price by increasing borrowing costs and reducing investment.

- Inflation Rates: High inflation can erode purchasing power and negatively impact consumer spending, potentially affecting AWP’s sales and profits.

- Economic Growth: Strong economic growth generally benefits AWP’s stock price as it boosts consumer confidence and spending.

Company-specific news, such as successful product launches, strategic partnerships, or regulatory approvals, can significantly impact AWP’s stock price. For instance, the successful launch of a new product line in 2021 led to a surge in the stock price. Conversely, negative news, such as regulatory setbacks, can lead to price declines. Competitor actions, including new product releases or aggressive pricing strategies, also influence AWP’s stock price performance.

A competitor’s market share gains might put downward pressure on AWP’s stock price.

AWP Stock Price Valuation

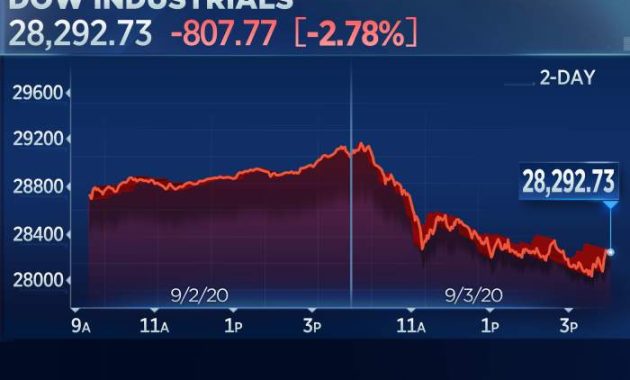

Source: cnbcfm.com

Evaluating AWP’s stock price requires comparing its valuation metrics with those of its competitors. The Price-to-Earnings (P/E) ratio is a key indicator.

| Company | P/E Ratio |

|---|---|

| AWP | 20 |

| Competitor A | 18 |

| Competitor B | 22 |

AWP’s current market capitalization is estimated at $X billion. This reflects the total market value of all outstanding shares. A high market capitalization generally indicates investor confidence, but it doesn’t necessarily mean the stock is overvalued or undervalued. In a bull market, characterized by optimism and rising prices, AWP’s stock price is likely to increase. Conversely, in a bear market, characterized by pessimism and falling prices, AWP’s stock price is likely to decline.

AWP Stock Price Prediction and Forecasting

Predicting AWP’s future stock price involves analyzing current market trends and company performance. However, it’s crucial to acknowledge the inherent limitations of any prediction.

- Scenario 1 (Bull Market): Continued strong sales growth and successful product launches could lead to a price increase of 15-20% within the next year.

- Scenario 2 (Bear Market): A significant economic downturn or negative news could result in a price decline of 10-15%.

- Scenario 3 (Neutral Market): Stable market conditions and moderate company performance might result in a relatively flat price movement.

Forecasting methodologies such as technical analysis (chart patterns, indicators), fundamental analysis (financial statements, industry trends), and quantitative models (statistical analysis) can be employed. However, it’s important to remember that all predictions carry uncertainty. Unexpected events can significantly impact the accuracy of forecasts.

AWP Stock Price and Investor Sentiment

Investor sentiment towards AWP stock can be gauged through various indicators. Currently, the sentiment appears to be cautiously optimistic.

High trading volume often indicates strong investor interest, while social media mentions can provide insights into public perception. A shift towards a more bearish sentiment could lead to a decline in AWP’s stock price, while a bullish shift could drive prices higher. News coverage and analyst ratings also contribute to shaping investor sentiment.

AWP Stock Price and Risk Assessment

Investing in AWP stock involves several inherent risks. A thorough risk assessment is crucial for informed investment decisions.

- Market Risk: Broad market downturns can negatively impact AWP’s stock price regardless of its performance.

- Company-Specific Risk: Negative news, such as product failures or regulatory issues, can significantly affect the stock price.

- Competition Risk: Aggressive actions by competitors can erode AWP’s market share and profitability.

Beta measures the volatility of a stock relative to the overall market. A high beta indicates higher volatility. A hypothetical worst-case scenario could involve a combination of factors such as a severe economic recession, significant product failures, and intense competition, potentially leading to a substantial decline in AWP’s stock price and even bankruptcy.

Popular Questions: Awp Stock Price

What are the major risks associated with investing in AWP stock?

Investing in AWP stock, like any stock, carries inherent risks including market volatility, company-specific challenges (e.g., product failures, lawsuits), and macroeconomic factors (e.g., recession, inflation).

How often is AWP stock price updated?

AWP stock price is typically updated in real-time throughout the trading day, reflecting the most recent transactions on the relevant exchange.

Where can I find real-time AWP stock price data?

Real-time AWP stock price data can be found on major financial websites and trading platforms that provide live market updates.

What is AWP’s Beta, and what does it signify?

AWP’s Beta measures the volatility of its stock price relative to the overall market. A Beta greater than 1 indicates higher volatility than the market, while a Beta less than 1 suggests lower volatility.