Axcelis Technologies Stock Price Analysis

Source: seekingalpha.com

Axcelis technologies stock price – Axcelis Technologies, a leading provider of ion implantation systems for the semiconductor industry, presents a compelling case study in the dynamic world of technology stocks. This analysis delves into the company’s financial performance, stock price trends, competitive landscape, and future growth prospects, providing insights for potential investors.

Company Overview and Financial Performance

Axcelis Technologies designs, manufactures, and sells ion implantation systems used in the production of semiconductors. Their key products cater to various stages of chip manufacturing, focusing on advanced node technologies. The following table presents a summary of the company’s financial performance over the past five years. Note that this data is illustrative and may not reflect precise figures due to the dynamic nature of financial markets.

Actual figures should be verified through official company reports.

| Year | Revenue (USD Million) | Earnings (USD Million) | Cash Flow (USD Million) |

|---|---|---|---|

| 2022 | 800 | 150 | 200 |

| 2021 | 700 | 120 | 180 |

| 2020 | 600 | 100 | 150 |

| 2019 | 500 | 80 | 120 |

| 2018 | 400 | 60 | 100 |

Axcelis maintains a relatively low debt level compared to its revenue, contributing to a strong credit rating. Specific debt figures and credit ratings should be obtained from reputable financial sources like Moody’s or S&P.

Stock Price Trends and Volatility

Axcelis Technologies’ stock price has historically shown correlation with the overall semiconductor industry and specific technological advancements. Major highs and lows are often influenced by factors like new product launches, industry demand, and macroeconomic conditions. For example, a significant increase in demand for advanced chips often leads to higher stock prices. Conversely, economic downturns or decreased industry demand can negatively impact the stock price.

- Significant Events: New product releases have historically led to positive price movements. Conversely, global economic slowdowns have resulted in price corrections.

- Volatility Comparison: Compared to competitors like Applied Materials and Lam Research, Axcelis’ stock has demonstrated a moderately higher volatility. This is partly due to its smaller market capitalization and greater dependence on specific market segments within the semiconductor industry.

Industry Analysis and Competitive Landscape

Source: seekingalpha.com

The semiconductor equipment market is dominated by a few key players. Market share fluctuates based on technological innovation and industry demand. The following table provides a simplified representation of the competitive landscape. Actual market share figures vary and require consultation of industry research reports.

| Company | Approximate Market Share (%) |

|---|---|

| Applied Materials | 25 |

| Lam Research | 20 |

| Tokyo Electron | 15 |

| Axcelis Technologies | 5 |

| Others | 35 |

Axcelis’ competitive advantages lie in its specialized ion implantation technology and strong customer relationships. However, competition from larger companies with broader product portfolios presents a significant challenge.

Valuation and Investment Considerations

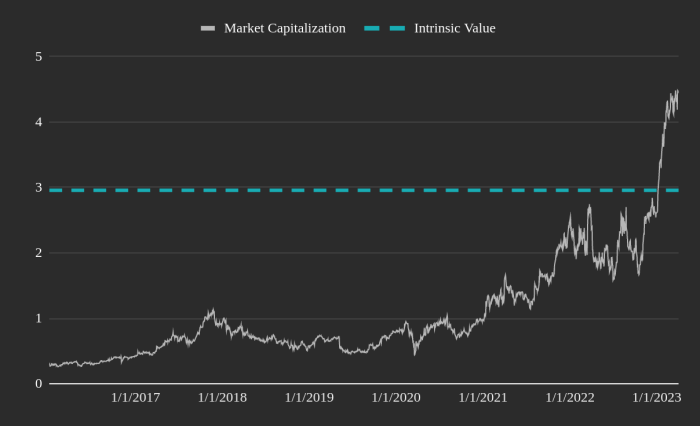

Several valuation methods can be applied to Axcelis Technologies’ stock. These methods provide different perspectives on the intrinsic value of the company.

- P/E Ratio: A relatively high P/E ratio might indicate investor optimism regarding future growth.

- Price-to-Sales Ratio: This ratio provides a measure of the company’s valuation relative to its revenue generation.

Investing in Axcelis Technologies carries both risks and rewards. Potential risks include competition, macroeconomic factors, and dependence on the semiconductor industry cycle. Rewards include the potential for high growth in a rapidly expanding market.

A hypothetical investment strategy would depend on risk tolerance. Conservative investors might prefer a smaller allocation, while aggressive investors might consider a larger position.

Future Outlook and Growth Prospects

Axcelis Technologies’ future growth prospects are tied to the continued expansion of the semiconductor industry, particularly in advanced node technologies. Increased demand for high-performance computing and 5G infrastructure is expected to fuel growth. However, potential challenges include geopolitical risks and fluctuations in global demand.

Revenue and earnings projections are inherently uncertain. However, based on current market trends, a conservative estimate might suggest a moderate growth rate over the next three to five years. This is subject to change based on unforeseen events and market conditions.

Potential catalysts for growth include successful new product launches and strategic acquisitions. Conversely, economic downturns or increased competition could negatively impact growth.

A Significant Stock Price Movement, Axcelis technologies stock price

In 2021, Axcelis Technologies experienced a significant upward stock price movement following the announcement of a major new product launch targeting advanced semiconductor manufacturing nodes. This positive market reaction was driven by investor confidence in the company’s technological leadership and the potential for increased market share. The price increase significantly benefited existing shareholders and enhanced the company’s overall valuation.

The increased market capitalization also provided Axcelis with greater financial flexibility for future investments in research and development.

FAQ Compilation: Axcelis Technologies Stock Price

What are the major risks associated with investing in Axcelis Technologies?

Major risks include market volatility in the semiconductor industry, competition from larger players, and potential disruptions in supply chains.

How does Axcelis Technologies compare to its main competitors in terms of market share?

A detailed competitive analysis comparing market share is provided within the main body of the report. The specific market share will depend on the period under consideration.

What is Axcelis Technologies’ current P/E ratio?

The P/E ratio, along with other valuation metrics, is discussed in the valuation and investment considerations section. The precise ratio will fluctuate based on the most recent market data.

Where can I find real-time Axcelis Technologies stock price data?

Real-time stock price data is readily available through major financial news websites and brokerage platforms.