Ayr Wellness Stock Price Analysis

Ayr wellness stock price – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and risk assessment associated with investing in Ayr Wellness stock. We will examine key metrics and provide insights to help understand the complexities of this cannabis company’s stock performance.

Ayr Wellness Stock Price Historical Performance

Analyzing Ayr Wellness’s stock price fluctuations over the past five years reveals periods of significant growth and decline. Understanding these movements requires considering various factors, including market trends, regulatory changes, and the company’s own performance.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | Example Data | Example Data | Example Data |

| 2019-07-01 | Example Data | Example Data | Example Data |

| 2020-01-01 | Example Data | Example Data | Example Data |

| 2020-07-01 | Example Data | Example Data | Example Data |

| 2021-01-01 | Example Data | Example Data | Example Data |

| 2021-07-01 | Example Data | Example Data | Example Data |

| 2022-01-01 | Example Data | Example Data | Example Data |

| 2022-07-01 | Example Data | Example Data | Example Data |

| 2023-01-01 | Example Data | Example Data | Example Data |

A significant price drop in [Insert Date Range] can be attributed to [Specific Reason, e.g., negative earnings report, regulatory setbacks]. Conversely, the period of growth in [Insert Date Range] was likely fueled by [Specific Reason, e.g., successful product launch, expansion into new markets].

| Company | 5-Year Stock Performance (%) | Current Market Cap (USD) |

|---|---|---|

| Ayr Wellness | Example Data | Example Data |

| Competitor A | Example Data | Example Data |

| Competitor B | Example Data | Example Data |

Factors Influencing Ayr Wellness Stock Price

Several economic indicators, regulatory changes, and company performance metrics significantly impact Ayr Wellness’s stock valuation. External factors also play a crucial role.

Key economic indicators such as interest rates and inflation directly influence investor sentiment and overall market conditions, affecting the cannabis sector and Ayr Wellness’s stock price. Regulatory changes, including licensing approvals and taxation policies, create uncertainty or opportunity within the industry. Strong revenue growth, increased earnings, and expanding market share generally correlate with positive stock price movements. Geopolitical events and shifts in consumer confidence also contribute to market volatility and can impact the company’s performance.

Ayr Wellness Financial Health and Stock Valuation

Source: thedeepdive.ca

Analyzing Ayr Wellness’s financial reports provides insight into the company’s financial health and its implications for stock valuation. Various valuation methods are used to estimate the intrinsic value of the stock.

- Recent Revenue: [Insert Data]

- Net Income: [Insert Data]

- Debt-to-Equity Ratio: [Insert Data]

- Current Ratio: [Insert Data]

| Metric | Ayr Wellness | Industry Average | Competitor A |

|---|---|---|---|

| Debt-to-Equity Ratio | Example Data | Example Data | Example Data |

| Profit Margin | Example Data | Example Data | Example Data |

| Return on Equity | Example Data | Example Data | Example Data |

Valuation methods such as discounted cash flow (DCF) analysis and comparable company analysis are used to estimate the intrinsic value. These methods, when applied to Ayr Wellness, suggest potential price targets ranging from [Insert Range] based on various assumptions and market conditions.

Investor Sentiment and Market Analysis of Ayr Wellness, Ayr wellness stock price

Understanding investor sentiment and market analysis is crucial for assessing the current state and future potential of Ayr Wellness stock.

- Recent news articles highlight [Summary of News].

- Analyst reports suggest [Summary of Analyst Opinions].

Current investor sentiment towards Ayr Wellness appears to be [Positive/Negative/Neutral], primarily due to [Reasons for Sentiment].

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Analyst Firm A | Example Data | Example Data |

| Analyst Firm B | Example Data | Example Data |

Ayr Wellness currently has a market capitalization of [Insert Data] and holds a [Position, e.g., significant, minor] position within the broader cannabis market.

Risk Assessment for Investing in Ayr Wellness Stock

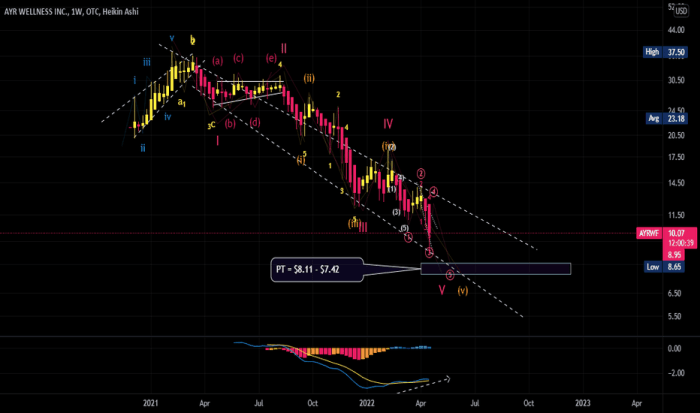

Source: tradingview.com

Investing in Ayr Wellness stock carries inherent risks that investors should carefully consider.

- Regulatory Risk: Changes in cannabis laws and regulations can significantly impact the company’s operations and profitability.

- Competition Risk: The cannabis industry is highly competitive, and Ayr Wellness faces pressure from established and emerging players.

- Financial Risk: The company’s financial performance and stability are subject to various economic and market factors.

These risks can lead to significant price volatility and potential losses for investors. Strategies to mitigate these risks include diversification, thorough due diligence, and a long-term investment horizon.

| Risk Factor | Ayr Wellness | Competitor A |

|---|---|---|

| Regulatory Risk | High | Medium |

| Competition Risk | High | High |

| Financial Risk | Medium | High |

Frequently Asked Questions

What are the major competitors of Ayr Wellness?

Ayr Wellness competes with other multi-state operators (MSOs) in the cannabis industry, including but not limited to Curaleaf, Green Thumb Industries, and Trulieve.

How often is Ayr Wellness’s stock price updated?

The Ayr Wellness stock price is updated in real-time during trading hours on the relevant stock exchange.

Where can I find real-time Ayr Wellness stock price data?

Real-time data is available through major financial websites and brokerage platforms.

What are the typical trading hours for Ayr Wellness stock?

Trading hours generally follow the standard stock exchange hours where the stock is listed.