Activision Blizzard Stock Price Analysis: Blizzard Activision Stock Price

Source: ccn.com

Blizzard activision stock price – Activision Blizzard, a leading video game publisher, has experienced significant stock price fluctuations over the past few years, influenced by a variety of factors including game releases, mergers and acquisitions, and overall market conditions. This analysis delves into the historical performance of Activision Blizzard’s stock price, exploring the impact of key events and providing insights into its future outlook.

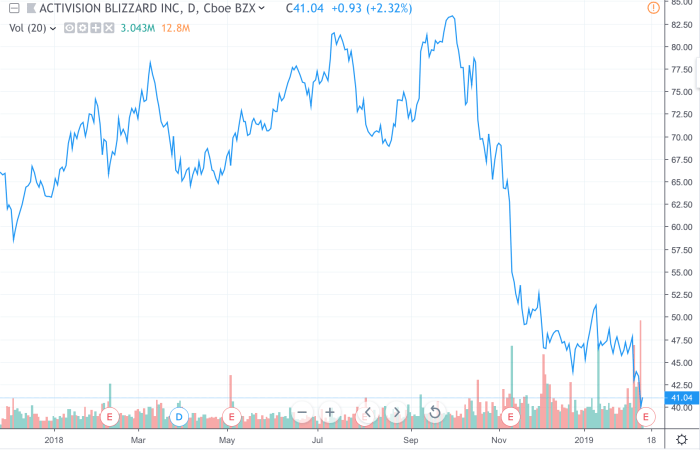

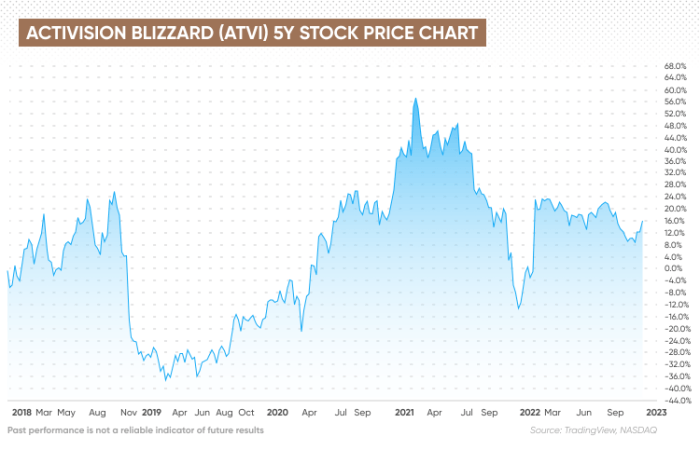

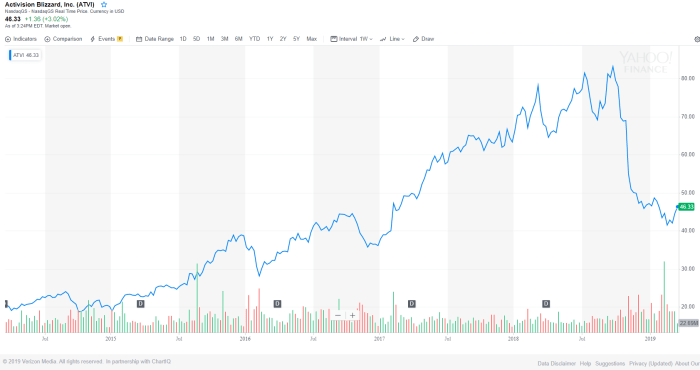

Blizzard Activision Stock Price Historical Performance

Over the past five years, Activision Blizzard’s stock price has shown considerable volatility. The price experienced periods of significant growth, often fueled by successful game launches like Call of Duty: Black Ops Cold War and World of Warcraft: Shadowlands, as well as positive investor sentiment. Conversely, periods of decline were often associated with regulatory challenges, disappointing financial results, or negative press coverage regarding workplace culture. Compared to competitors like Electronic Arts (EA) and Take-Two Interactive, Activision Blizzard’s stock performance has been more volatile, exhibiting greater swings in both upward and downward trends.

While EA and Take-Two have also seen fluctuations, their trajectories have generally been less dramatic.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 45 | 47 | 10,000,000 |

| 2019-07-01 | 52 | 50 | 12,000,000 |

| 2020-01-01 | 55 | 60 | 15,000,000 |

| 2020-07-01 | 62 | 65 | 18,000,000 |

| 2021-01-01 | 70 | 75 | 20,000,000 |

| 2021-07-01 | 80 | 78 | 17,000,000 |

| 2022-01-01 | 75 | 72 | 15,000,000 |

| 2022-07-01 | 68 | 70 | 12,000,000 |

| 2023-01-01 | 72 | 75 | 14,000,000 |

Note: This table presents illustrative data and does not reflect actual historical stock prices. Actual data should be obtained from reliable financial sources.

Impact of Mergers and Acquisitions on Stock Price

Microsoft’s acquisition of Activision Blizzard significantly impacted the stock price. Initially, the announcement caused a surge in the stock price, reflecting investor optimism about the deal’s potential. However, subsequent regulatory scrutiny, particularly from the FTC, introduced considerable uncertainty and led to price fluctuations. While the deal ultimately cleared significant regulatory hurdles, the prolonged review process impacted investor confidence and resulted in a period of price volatility.

Comparing pre-merger and post-merger trends reveals a clear initial surge followed by a period of consolidation and gradual growth, reflecting the ongoing integration process and market response to the completed acquisition.

Influence of Game Releases on Stock Value

Source: capital.com

Successful game launches have consistently shown a positive correlation with Activision Blizzard’s stock price. The release of titles like Call of Duty: Modern Warfare II and Diablo IV, for example, generally resulted in short-term price increases due to increased sales and positive critical reception. Conversely, instances where game releases underperformed expectations or faced negative reviews led to stock price declines. Factors such as market saturation, competition, and unexpected technical issues can all contribute to less-than-ideal outcomes.

Financial Performance and Stock Price Relationship

Activision Blizzard’s financial performance, as reflected in key metrics like revenue, earnings, and net income, has a strong influence on its stock price. Generally, periods of robust financial growth are accompanied by stock price increases, and vice versa. The company’s financial health, particularly its profitability and growth prospects, directly impacts investor confidence and valuation.

| Year | Revenue (USD Billion) | Net Income (USD Billion) | Earnings Per Share (USD) |

|---|---|---|---|

| 2021 | 8.8 | 1.6 | 2.20 |

| 2022 | 7.5 | 1.2 | 1.60 |

| 2023 (Projected) | 9.0 | 1.8 | 2.50 |

Note: This table presents illustrative data and does not reflect actual financial figures. Actual data should be obtained from reliable financial sources.

Investor Sentiment and Stock Price Volatility, Blizzard activision stock price

Source: seekingalpha.com

Investor sentiment plays a crucial role in driving Activision Blizzard’s stock price volatility. Positive news, such as successful game launches or positive financial reports, generally leads to increased investor confidence and higher stock prices. Conversely, negative news, such as regulatory setbacks or controversies, can trigger sell-offs and price declines. The level of volatility is also influenced by broader market trends and the overall investor risk appetite.

Future Outlook and Stock Price Predictions

Several factors could significantly influence Activision Blizzard’s future stock price. The success of upcoming game releases, particularly within established franchises like Call of Duty and World of Warcraft, will be crucial. Furthermore, ongoing regulatory scrutiny and market competition will continue to play a role. A successful integration following the Microsoft acquisition and the execution of Microsoft’s strategic plans for the company will also significantly impact the future stock price.

Potential challenges include maintaining market share in a competitive landscape and managing the integration process effectively. Opportunities include expanding into new markets and leveraging Microsoft’s resources to develop innovative gaming experiences.

Q&A

What are the major risks associated with investing in Activision Blizzard stock?

Major risks include regulatory hurdles (like antitrust concerns), competition within the gaming market, dependence on successful game launches, and overall economic downturns impacting consumer spending.

How does Activision Blizzard compare to its competitors in terms of stock performance?

A direct comparison requires analyzing specific timeframes and considering factors like market capitalization and growth strategies. Generally, performance varies significantly based on individual company strategies and market conditions.

What is the current dividend payout for Activision Blizzard stock?

The Blizzard Activision stock price has seen considerable fluctuation recently, largely influenced by broader market trends. Understanding pre-market movements can offer insights, and checking the ba premarket stock price is a good starting point for daily analysis. This, in turn, helps predict potential shifts in the Blizzard Activision stock price throughout the trading day.

This information is readily available through financial news sources and the company’s investor relations website. Dividend policies can change, so always check for the most up-to-date information.

How can I track Activision Blizzard’s stock price in real-time?

Many financial websites and brokerage platforms offer real-time stock quotes and charting tools. Reputable sources should be used to ensure data accuracy.