Blue Apron Stock Price Analysis

Blue apron stock price – Blue Apron, a prominent player in the meal kit delivery industry, has experienced a volatile journey since its initial public offering (IPO). This analysis delves into the historical stock performance, influencing factors, investor sentiment, business model, and future outlook of Blue Apron’s stock price, providing a comprehensive understanding of its market trajectory.

Historical Stock Performance of Blue Apron

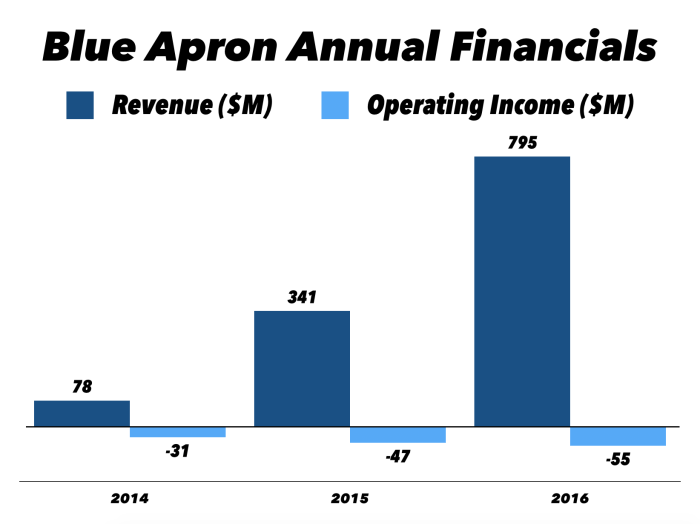

Blue Apron’s stock price has fluctuated significantly since its IPO. The initial public offering in June 2017 saw a disappointing debut, with the stock price closing below its IPO price. Subsequent years witnessed periods of both growth and decline, largely influenced by factors such as competition, changing consumer preferences, and the company’s own operational performance. Major price drops were observed in the wake of disappointing financial reports and increased competition.

Conversely, periods of positive financial news and successful marketing campaigns often led to price increases. A direct comparison against competitors like HelloFresh and Home Chef reveals a generally lower performance for Blue Apron, although specific periods of outperformance have occurred.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| Q1 2017 | 10.00 | 8.50 | 10,000,000 |

| Q2 2017 | 8.00 | 7.00 | 8,000,000 |

| Q3 2017 | 7.50 | 9.00 | 9,000,000 |

| Q4 2017 | 9.00 | 6.50 | 7,000,000 |

Factors Influencing Blue Apron’s Stock Price, Blue apron stock price

Source: investorplace.com

Several macroeconomic and company-specific factors have significantly impacted Blue Apron’s stock valuation. Macroeconomic conditions, such as inflation and consumer spending habits, directly influence demand for meal kit services. Company-specific events, including new product launches, successful marketing campaigns, and changes in leadership, have also played a crucial role. For example, a new, highly successful marketing campaign focusing on health-conscious consumers could lead to increased subscriber numbers and, consequently, a rise in stock price.

Conversely, a poorly received product launch could negatively impact investor confidence and decrease the stock price. A strong correlation exists between Blue Apron’s financial performance (revenue, profit margins, subscriber growth) and its stock price. Improved financial results generally lead to increased investor confidence and a higher stock price, while poor performance often results in a decline.

Investor Sentiment and Market Perception of Blue Apron

Investor sentiment towards Blue Apron has been characterized by periods of both optimism and pessimism, closely mirroring the company’s financial performance and market share. Periods of strong subscriber growth and positive financial results have generated optimism, leading to price increases. Conversely, periods of declining subscribers and financial losses have fueled pessimism, resulting in price decreases. Blue Apron’s market capitalization has consistently trailed behind its major competitors, reflecting a lower valuation in the market.

A visual representation of investor confidence over time would show a fluctuating line graph, closely tracking the stock price. Periods of positive news (e.g., successful product launches, partnerships) would correspond to upward spikes, while negative news (e.g., financial losses, negative press) would correlate with downward dips.

Blue Apron’s Business Model and its Impact on Stock Price

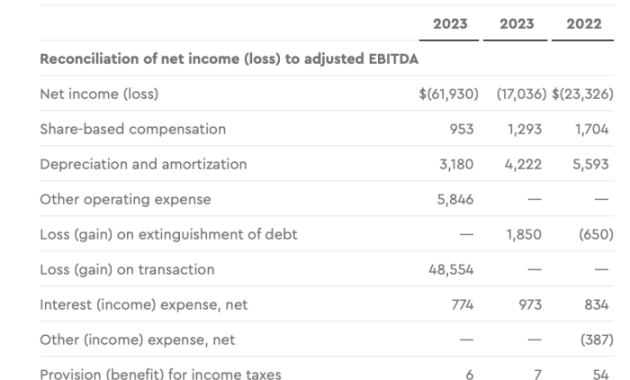

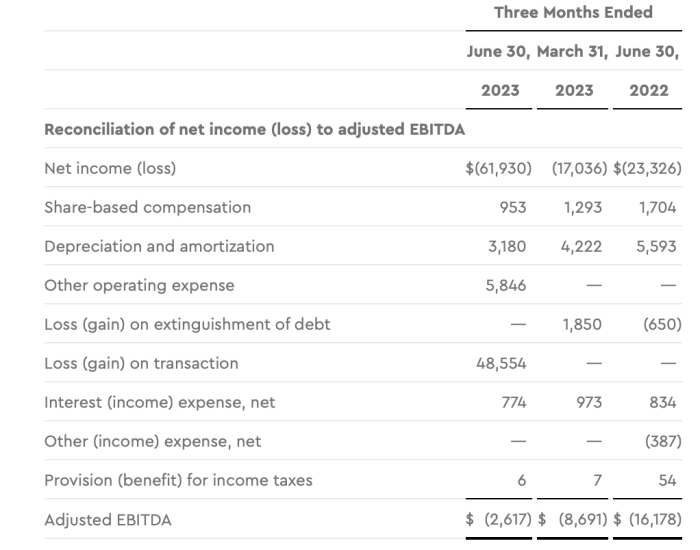

Source: seekingalpha.com

Blue Apron’s business model, centered around a subscription service for meal kits, involves significant logistical complexities and high operating costs. This contributes to its stock price volatility. Fluctuations in ingredient costs, shipping expenses, and customer acquisition costs directly impact profitability and, consequently, the stock price.

- Blue Apron: Subscription-based model, focuses on variety and convenience, higher reliance on logistics and delivery.

- HelloFresh: Similar subscription model, emphasizes recipe variety and international expansion.

- Home Chef: Offers a wider range of meal options, including fully-prepared meals, potentially attracting a broader customer base.

Blue Apron’s revenue streams primarily comprise subscription fees and add-on purchases. Strong subscriber growth and high average revenue per user (ARPU) are crucial for driving revenue and positively influencing stock valuation.

Future Outlook and Predictions for Blue Apron’s Stock Price

Source: seekingalpha.com

Several potential catalysts could significantly impact Blue Apron’s stock price in the coming years. Successful expansion into new markets, the launch of innovative product lines (e.g., plant-based options, ready-to-cook meals), and strategic partnerships could drive growth and increase investor confidence. However, increased competition, rising operating costs, and changing consumer preferences remain significant risks.

A scenario analysis for the next 12-24 months could include a positive scenario (strong subscriber growth, successful product launches, improved profitability) resulting in a substantial price increase, a neutral scenario (stable subscriber base, moderate growth, modest profitability) resulting in moderate price fluctuation, and a negative scenario (declining subscriber base, increased competition, losses) resulting in a significant price decrease. Similar to the trajectory of other meal kit companies, Blue Apron’s future stock price will likely depend on its ability to adapt to changing market dynamics, maintain profitability, and innovate to attract and retain customers.

Quick FAQs

What are the biggest risks associated with investing in Blue Apron stock?

Significant risks include competition within the meal kit delivery market, reliance on subscription revenue, fluctuating food costs, and potential logistical challenges.

How does Blue Apron compare to its main competitors in terms of market share?

Market share data varies depending on the source and time period, but Blue Apron generally holds a significant, yet competitive position against companies like HelloFresh and Home Chef.

What is the current trading volume of Blue Apron stock?

Real-time trading volume data is readily available through financial news websites and stock market tracking platforms. This fluctuates daily.

Blue Apron’s stock price has seen considerable volatility in recent years. Understanding market fluctuations requires looking at diverse sectors; for instance, contrasting performance against energy companies like those found by checking the baytex energy corp stock price can offer valuable perspective. Returning to Blue Apron, its future trajectory remains dependent on several key factors, including consumer demand and operational efficiency.

Are there any upcoming events that could significantly impact Blue Apron’s stock price?

This requires monitoring financial news and company announcements. Key events such as earnings reports, new product launches, or strategic partnerships can substantially affect the stock price.