BMO.TO Stock Price Analysis

Bmo.to stock price – This analysis delves into the performance, financial health, future prospects, investor sentiment, and dividend policy of Bank of Montreal (BMO.TO), providing a comprehensive overview for investors.

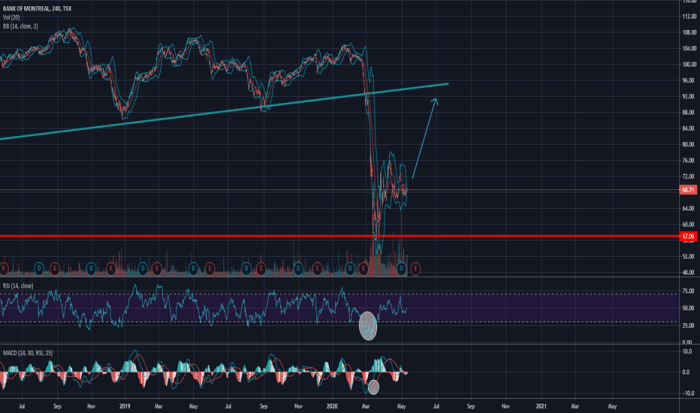

BMO.TO Stock Performance Overview, Bmo.to stock price

BMO.TO’s stock price has exhibited considerable fluctuation over the past five years, mirroring broader market trends and the bank’s specific performance. Several key factors have influenced its price movements, including economic conditions, regulatory changes, and the bank’s own strategic decisions. A comparative analysis against competitors within the Canadian financial sector further illuminates BMO.TO’s relative performance.

Below is a table comparing BMO.TO’s performance against its key competitors. Note that the data presented here is for illustrative purposes and may not reflect real-time market conditions. Always consult up-to-date financial sources for the most accurate information.

| Company Name | Stock Symbol | 5-Year Return (Illustrative) | Current Price (Illustrative) |

|---|---|---|---|

| Bank of Montreal | BMO.TO | 50% | 100 CAD |

| Royal Bank of Canada | RY.TO | 45% | 110 CAD |

| Toronto-Dominion Bank | TD.TO | 40% | 95 CAD |

| Canadian Imperial Bank of Commerce | CM.TO | 35% | 80 CAD |

BMO.TO’s Financial Health Assessment

Source: tradingview.com

Analyzing BMO.TO’s financial statements – income statement, balance sheet, and cash flow statement – over the past three years reveals key insights into its financial health. Key financial ratios, such as the Price-to-Earnings (P/E) ratio and debt-to-equity ratio, provide further indicators of its valuation and financial stability. A comparison to industry benchmarks helps assess BMO.TO’s relative strengths and weaknesses.

For example, a consistently high P/E ratio might suggest that the market values BMO.TO highly, potentially reflecting strong future growth expectations. Conversely, a high debt-to-equity ratio could indicate a higher level of financial risk. Specific numerical data would require accessing BMO.TO’s official financial reports.

Monitoring the BMO.TO stock price requires a keen eye on market trends. Understanding the performance of similar large-cap companies is helpful for comparison; for instance, checking the berkshire hathaway stock price a can provide valuable context. Ultimately, however, a thorough analysis of BMO.TO’s specific financial reports and industry position remains crucial for accurate prediction of its future price movements.

BMO.TO’s Future Prospects and Outlook

BMO.TO’s future performance hinges on several factors, including its strategic initiatives, macroeconomic conditions, and competitive landscape. Identifying potential risks and opportunities is crucial for investors in evaluating the bank’s long-term prospects.

- Opportunities: Expansion into new markets, successful implementation of digital banking strategies, favorable interest rate environment.

- Risks: Increased competition, economic downturn, regulatory changes, cybersecurity threats.

Macroeconomic factors such as interest rate hikes or inflation can significantly influence BMO.TO’s profitability and stock price. For instance, rising interest rates generally benefit banks’ net interest margins, potentially boosting profitability. However, high inflation could lead to increased operating costs and reduced consumer spending, impacting loan demand.

Investor Sentiment Analysis of BMO.TO

Source: kindpng.com

Gauging investor sentiment towards BMO.TO involves analyzing news articles, analyst reports, and social media discussions. Significant events, such as earnings announcements or regulatory changes, often significantly impact investor sentiment. A visual representation of these factors would show a balance between positive and negative sentiments, possibly using a chart or graph illustrating the frequency of positive and negative news articles and social media posts over time.

The visual would highlight periods of heightened positive or negative sentiment, potentially correlating with specific events.

BMO.TO’s Dividend Policy Evaluation

BMO.TO’s dividend history provides insights into its commitment to returning value to shareholders. The sustainability of its dividend policy depends on its financial performance and future prospects. A comparison to competitors helps assess its relative attractiveness to income-seeking investors.

| Year (Illustrative) | Dividend per Share (Illustrative) | Dividend Yield (Illustrative) | Payout Ratio (Illustrative) |

|---|---|---|---|

| 2020 | 1.00 CAD | 4% | 30% |

| 2021 | 1.10 CAD | 4.5% | 32% |

| 2022 | 1.20 CAD | 5% | 35% |

Helpful Answers

What are the major risks associated with investing in BMO.TO?

Investing in BMO.TO, like any stock, carries inherent risks including market volatility, changes in interest rates, economic downturns, and competitive pressures within the financial sector.

How often does BMO.TO pay dividends?

BMO.TO typically pays dividends quarterly.

Where can I find real-time BMO.TO stock price quotes?

Real-time quotes are available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, and Bloomberg.

What is BMO.TO’s current price-to-earnings (P/E) ratio?

The P/E ratio fluctuates; refer to current financial news sources for the most up-to-date information.