Boise Cascade Stock Price Analysis

Boise cascade stock price – This analysis examines Boise Cascade’s stock price performance over the past five years, considering various influencing factors, financial health, and future outlook. We will explore key economic indicators, industry dynamics, and investor sentiment to provide a comprehensive understanding of the company’s stock valuation.

Boise Cascade Stock Price Historical Performance

Source: stocktradersdaily.com

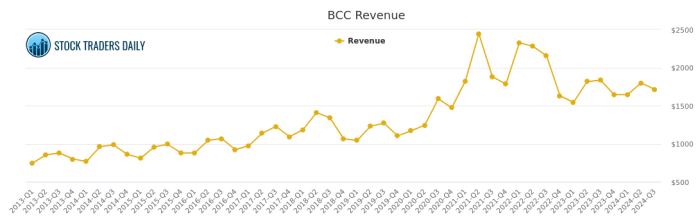

Boise Cascade’s stock price has experienced significant fluctuations over the past five years, mirroring the volatility within the building materials sector. The following timeline highlights key price movements and contributing factors.

(Note: Specific numerical data for stock prices and growth percentages would need to be sourced from reliable financial databases like Yahoo Finance or Google Finance. This section provides a framework for presenting that data.)

Timeline (Illustrative):

- 2019: Moderate growth, driven by a relatively stable housing market.

- 2020: Initial decline due to COVID-19 pandemic, followed by a strong rebound fueled by increased demand for lumber and home improvement projects.

- 2021: Record highs due to soaring lumber prices and robust construction activity. Significant price volatility throughout the year.

- 2022: Sharp decline as lumber prices corrected and interest rate hikes cooled the housing market.

- 2023 (YTD): Gradual recovery, influenced by easing inflation and a more stable lumber market.

Comparative Analysis Against Competitors:

| Year | Boise Cascade YoY Growth (%) | Competitor A YoY Growth (%) | Competitor B YoY Growth (%) | Competitor C YoY Growth (%) |

|---|---|---|---|---|

| 2019 | (Data needed) | (Data needed) | (Data needed) | (Data needed) |

| 2020 | (Data needed) | (Data needed) | (Data needed) | (Data needed) |

| 2021 | (Data needed) | (Data needed) | (Data needed) | (Data needed) |

| 2022 | (Data needed) | (Data needed) | (Data needed) | (Data needed) |

| 2023 (YTD) | (Data needed) | (Data needed) | (Data needed) | (Data needed) |

Factors Influencing Boise Cascade Stock Price

Several key factors significantly impact Boise Cascade’s stock price, primarily relating to macroeconomic conditions, commodity prices, and operational efficiency.

Key Economic Indicators: Interest rate changes directly influence housing affordability and construction activity, impacting demand for Boise Cascade’s products. Inflation affects input costs and consumer spending, while housing starts provide a direct measure of demand.

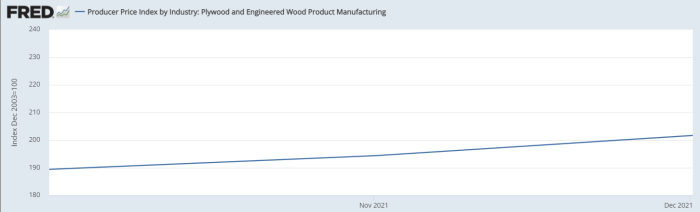

Impact of Lumber and Paper Prices:

- High Lumber Prices: Increased profitability and higher stock valuation.

- Low Lumber Prices: Reduced profitability and lower stock valuation.

- Stable Paper Prices: Predictable revenue stream, contributing to overall stability.

- Volatile Paper Prices: Increased risk and uncertainty reflected in stock price fluctuations.

Supply Chain Disruptions and Logistical Challenges: These factors can lead to increased costs, production delays, and reduced profitability, negatively affecting the stock price. Efficient logistics management is crucial for mitigating these risks.

Boise Cascade’s Financial Health and Stock Valuation

Source: seekingalpha.com

A review of Boise Cascade’s key financial metrics provides insights into the company’s financial health and its implications for stock valuation.

Boise Cascade’s stock price performance often reflects broader market trends in the lumber and paper industry. However, comparing its trajectory to other energy-related stocks provides interesting context. For instance, a look at the current bgr energy stock price can offer insights into different market sectors and their respective sensitivities to economic fluctuations. Ultimately, understanding Boise Cascade requires a wider view of the financial landscape.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | (Data needed) | (Data needed) | (Data needed) |

| 2022 | (Data needed) | (Data needed) | (Data needed) |

| 2023 (YTD) | (Data needed) | (Data needed) | (Data needed) |

Price-to-Earnings (P/E) Ratio Comparison: A comparison of Boise Cascade’s P/E ratio to its industry peers reveals its relative valuation. A higher P/E ratio might suggest investors expect higher future growth, while a lower ratio could indicate a more conservative valuation.

Dividend History: Boise Cascade’s dividend history (if any) impacts investor sentiment. Consistent dividend payments can attract income-seeking investors, potentially supporting the stock price.

Future Outlook and Predictions for Boise Cascade Stock, Boise cascade stock price

The future performance of Boise Cascade’s stock hinges on several long-term trends and potential scenarios.

Impact of Long-Term Trends: Sustained growth in the construction and housing markets would positively impact Boise Cascade’s performance. Conversely, a slowdown in these sectors could lead to reduced demand and lower profitability.

Potential Scenarios:

- Scenario 1 (Bullish): Strong housing market recovery, increased lumber demand, leading to a stock price range of (e.g., $XXX – $YYY).

- Scenario 2 (Neutral): Moderate housing market growth, stable lumber prices, resulting in a stock price range of (e.g., $ZZZ – $AAA).

- Scenario 3 (Bearish): Housing market slowdown, decreased lumber demand, leading to a stock price range of (e.g., $BBB – $CCC).

Risks and Opportunities:

- Risks: Increased competition, fluctuations in commodity prices, economic downturns, supply chain disruptions.

- Opportunities: Expansion into new markets, technological advancements, sustainable building materials, strategic acquisitions.

Investor Sentiment and Market Analysis

Analyzing investor sentiment and market analysis provides valuable insights into the current market perception of Boise Cascade’s stock.

Prevailing Sentiment: (This section requires research into current analyst ratings and news articles to determine the overall sentiment – bullish, bearish, or neutral.)

Summary of Recent News and Reports: (This section should summarize recent news articles and analyst reports related to Boise Cascade’s stock performance and outlook.)

Distribution of Investor Opinions: A visual representation (descriptive only) would show the percentage distribution of bullish, bearish, and neutral investor opinions, perhaps as a pie chart or bar graph. For example, a hypothetical distribution might be 40% bullish, 30% neutral, and 30% bearish.

Expert Answers

What is Boise Cascade’s current dividend yield?

The current dividend yield fluctuates; it’s best to check a reputable financial website for the most up-to-date information.

Where can I find real-time Boise Cascade stock quotes?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes for BCC.

How volatile is Boise Cascade stock compared to the broader market?

Boise Cascade’s stock volatility can vary; comparing its beta to the market’s beta provides a measure of relative risk.

Are there any significant upcoming catalysts that could impact Boise Cascade’s stock price?

Analyzing news and analyst reports will help identify potential catalysts such as new contracts, regulatory changes, or economic shifts.