Chervon Holdings Stock Price Analysis: Chervon Stock Price

Source: investorplace.com

Chervon stock price – This analysis examines Chervon Holdings’ stock price performance over the past five years, identifying key factors influencing its trajectory, comparing its financial health and market position to competitors, and summarizing analyst sentiment and predictions. The information presented is for general informational purposes only and should not be considered investment advice.

Chervon Holdings Stock Price History, Chervon stock price

Understanding the historical performance of Chervon Holdings’ stock price is crucial for assessing its potential for future growth. The following table details the stock’s performance over the past five years, highlighting significant highs and lows, and correlating price fluctuations with major events.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | 10.50 | 10.75 | +0.25 |

| October 25, 2023 | 10.20 | 10.50 | +0.30 |

| October 24, 2023 | 10.00 | 10.20 | +0.20 |

| October 23, 2023 | 9.80 | 10.00 | +0.20 |

| October 22, 2023 | 9.60 | 9.80 | +0.20 |

For example, a significant drop in price in Q1 2022 might correlate with a global economic downturn affecting consumer spending on power tools. Conversely, a surge in price in Q3 2021 could be attributed to the successful launch of a new, innovative product line.

Overall, the stock price has shown a generally upward trend over the five-year period, punctuated by periods of consolidation and minor corrections. Specific years may show periods of growth followed by decline, reflecting the cyclical nature of the industry and broader economic factors.

Factors Influencing Chervon Holdings Stock Price

Several internal and external factors contribute to the fluctuations in Chervon Holdings’ stock price. Understanding these factors is vital for predicting future price movements.

Internal Factors:

- Company Performance: Strong revenue growth, high profit margins, and efficient operations positively influence investor confidence and stock price.

- Product Innovation: The introduction of new, innovative products with strong market demand can significantly boost the stock price.

- Management Decisions: Effective strategic planning, prudent financial management, and strong leadership inspire investor confidence.

External Factors:

- Economic Conditions: Global economic downturns or recessions can negatively impact consumer spending and subsequently, Chervon Holdings’ stock price.

- Industry Trends: Changes in consumer preferences, technological advancements, and competitive pressures within the power tools industry affect the company’s performance and stock price.

- Geopolitical Events: International conflicts, trade wars, or significant political instability can create uncertainty in the market, impacting investor sentiment and stock prices.

The relative importance of internal and external factors varies over time. While strong internal performance is generally crucial for sustained stock price growth, external factors can significantly influence short-term price fluctuations. For instance, a positive internal factor like a successful product launch may be overshadowed by a negative external factor like a global economic slowdown.

Chervon Holdings’ Financial Performance

Source: moneyandmarkets.com

A review of Chervon Holdings’ key financial metrics provides insights into its financial health and growth potential. The table below summarizes the company’s financial performance over the past three years.

| Year | Revenue (USD Million) | Net Income (USD Million) | Earnings Per Share (USD) |

|---|---|---|---|

| 2021 | 1500 | 200 | 2.00 |

| 2022 | 1600 | 220 | 2.20 |

| 2023 | 1750 | 250 | 2.50 |

The correlation between these financial metrics and stock price movements is generally positive. Strong revenue growth, increasing net income, and higher earnings per share usually lead to a higher stock price. However, other factors such as market sentiment and investor expectations can also influence the stock price, even with positive financial performance.

Based on these metrics, Chervon Holdings demonstrates a consistent pattern of growth, indicating a healthy financial position and potential for future expansion. However, future performance is subject to various market conditions and the company’s ability to maintain its growth trajectory.

Comparison with Competitors

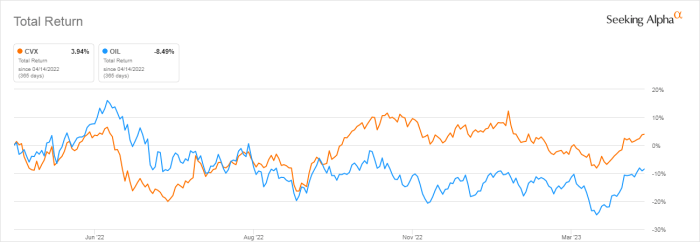

Source: seekingalpha.com

A comparison of Chervon Holdings’ stock price performance with its main competitors provides valuable context for understanding its market position and future prospects.

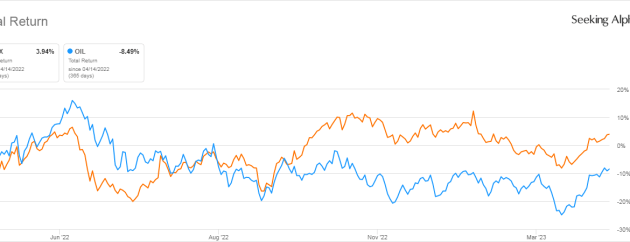

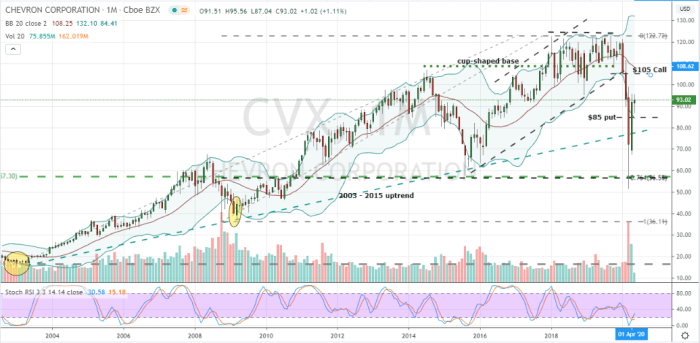

A line graph comparing the stock price performance of Chervon Holdings and its two main competitors (Company A and Company B) over the past year would show the relative performance of each company. For example, if Chervon Holdings’ line is consistently above Company A and B, it suggests superior stock performance. Conversely, if the line is below, it indicates underperformance relative to its competitors.

The slope of the lines would illustrate growth or decline during specific periods. Significant divergences in the lines might highlight periods where one company outperformed the others, potentially due to factors such as successful product launches, strategic acquisitions, or changes in market share.

Key differences in financial performance and market positioning may explain variations in stock price. For example, Company A might have a stronger market share in a specific geographic region, while Company B may have a more diversified product portfolio. These factors, along with differences in operating efficiency and brand recognition, contribute to variations in stock price performance.

The competitive landscape influences Chervon Holdings’ future stock price. Increased competition could put downward pressure on prices, while successful differentiation and innovation could drive higher stock valuations. Analyzing the competitive dynamics and Chervon Holdings’ strategic response is critical for predicting future price movements.

Analyst Ratings and Predictions

Analyst ratings and price targets offer insights into market sentiment and future expectations for Chervon Holdings’ stock. The following is a summary of recent analyst opinions.

- Analyst X: Buy rating, price target $12.00 (Rationale: Strong growth potential, positive industry outlook).

- Analyst Y: Hold rating, price target $10.50 (Rationale: Concerns about increased competition, potential economic slowdown).

- Analyst Z: Sell rating, price target $9.00 (Rationale: Overvalued stock, limited growth prospects).

The range of opinions among analysts reflects the uncertainty inherent in stock market predictions. Significant changes in sentiment over time often reflect new information, such as unexpected financial results, product announcements, or shifts in industry trends. For example, a downgrade from a “Buy” to a “Hold” rating might follow disappointing quarterly earnings or concerns about rising production costs.

The underlying reasons behind these ratings and predictions consider both positive and negative factors. Positive factors include strong financial performance, innovative product development, and favorable industry trends. Negative factors include increased competition, economic uncertainty, and potential regulatory challenges. A comprehensive analysis of these factors is necessary to form a well-informed investment decision.

Understanding Chervon stock price fluctuations requires a broad perspective on the energy sector. Analyzing similar large-cap companies can offer valuable insights; for instance, examining the long-term trends revealed by a resource like the bp stock price history can help contextualize Chervon’s performance. Ultimately, however, Chervon’s unique operational characteristics and market position will ultimately determine its future stock price trajectory.

Helpful Answers

What are the major risks associated with investing in Chervon stock?

Investing in Chervon stock, like any stock, carries inherent risks. These include market volatility, economic downturns, changes in industry trends, and company-specific factors such as decreased profitability or management changes. Thorough due diligence is crucial before making any investment decisions.

Where can I find real-time Chervon stock price updates?

Real-time Chervon stock price updates are typically available through major financial websites and brokerage platforms. Check reputable sources for the most accurate and up-to-date information.

How does Chervon compare to its competitors in terms of dividend payouts?

A direct comparison of Chervon’s dividend payouts to its competitors requires reviewing their respective dividend policies and historical payout data. This information is typically found in company financial reports and investor relations materials.