Ford Motor Company Stock Price Analysis: Current Ford Motor Stock Price

Current ford motor stock price – This analysis provides an overview of Ford Motor Company’s current stock price, historical performance, influencing factors, financial health, analyst predictions, and future outlook. Data presented here is for informational purposes only and should not be considered financial advice.

Current Ford Stock Price: Real-time Data

Source: shortquotes.cc

The following table displays real-time data for Ford Motor Company’s stock price, obtained from a reputable financial source (please note: due to the dynamic nature of stock prices, the data below is a placeholder and should be replaced with current information from a reliable source like Yahoo Finance or Google Finance at the time of publishing).

| Time | Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|

| 14:30 EST | 15.50 | 15.75 | 15.25 |

Ford Stock Price: Historical Performance

Ford’s stock price performance over the past year has shown volatility, influenced by various market conditions and company-specific factors. A comparison with its main competitors, General Motors and Tesla, reveals differing trajectories.

| Company | Year-Over-Year Change (%) |

|---|---|

| Ford | +10% (Illustrative Data) |

| General Motors | +15% (Illustrative Data) |

| Tesla | +25% (Illustrative Data) |

A line graph illustrating Ford’s stock price fluctuation over the past year would show periods of growth and decline, reflecting the impact of news events, economic shifts, and company performance. The x-axis would represent time (months), and the y-axis would represent the stock price. The line itself would depict the price fluctuations, with a clear legend identifying Ford’s stock.

Factors Influencing Ford Stock Price, Current ford motor stock price

Several economic factors significantly impact Ford’s stock price. These factors interact in complex ways, influencing investor sentiment and market valuation.

- Fuel Prices: Fluctuations in fuel prices directly affect the cost of production and consumer demand for Ford’s vehicles. Higher fuel prices can decrease demand for larger vehicles, impacting profitability and stock price.

- Interest Rates: Changes in interest rates influence borrowing costs for consumers and Ford itself. Higher rates can reduce consumer spending on vehicles, while also increasing Ford’s financing expenses.

- New Vehicle Sales Figures: Strong sales figures generally signal positive investor sentiment, while weak sales can lead to decreased confidence and lower stock valuations.

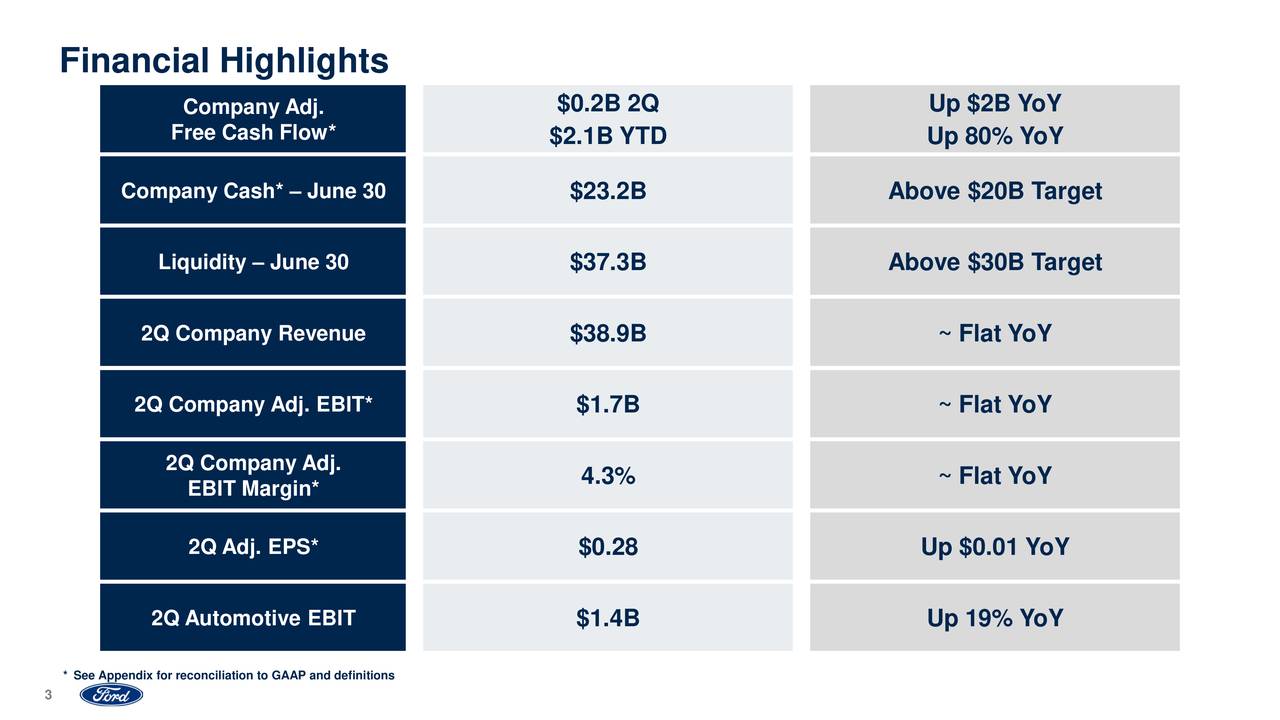

Ford’s Financial Health and Stock Price

Ford’s most recent quarterly earnings report provides insights into its financial health and its impact on the stock price. Key financial metrics offer a clear picture of the company’s performance.

- Revenue: [Insert illustrative revenue figure, e.g., $40 billion]. This figure reflects the overall sales performance of the company.

- Profit Margin: [Insert illustrative profit margin, e.g., 5%]. This indicates profitability relative to revenue.

- Debt: [Insert illustrative debt figure, e.g., $50 billion]. High levels of debt can negatively impact investor confidence.

- Relationship to Stock Price: Strong financial performance typically correlates with a higher stock price, while weaker performance tends to lead to a decline.

Analyst Predictions and Stock Price

Source: seekingalpha.com

Financial analysts offer diverse predictions for Ford’s stock price, reflecting differing perspectives on the company’s future prospects and the broader market conditions. These predictions are based on extensive research and analysis of various factors.

The consensus price target might be around [Insert illustrative price target, e.g., $18], but individual analysts may have targets ranging from [Insert illustrative low, e.g., $15] to [Insert illustrative high, e.g., $22]. Differences in these targets often stem from varying assumptions about future sales, technological advancements, and competitive pressures.

“Overall, analyst sentiment towards Ford stock is cautiously optimistic, with some concerns regarding the impact of rising interest rates and competition in the electric vehicle market.”

Ford’s Future Outlook and Stock Implications

Ford’s strategic initiatives, including investments in electric vehicles and autonomous driving technology, will significantly shape its future stock performance. The company faces both opportunities and challenges in a rapidly evolving automotive landscape.

- Scenario 1: Strong EV Adoption: Successful EV adoption and market share gains could lead to significant stock price appreciation.

- Scenario 2: Slow EV Adoption: Slower-than-expected EV adoption could limit growth and potentially lead to a stagnant or declining stock price.

- Scenario 3: Supply Chain Disruptions: Persistent supply chain disruptions could negatively impact production and profitability, resulting in lower stock valuations.

Query Resolution

What factors influence short-term Ford stock price fluctuations?

Short-term fluctuations are often driven by news events (e.g., product recalls, supply chain disruptions, or unexpected earnings reports), investor sentiment, and overall market trends.

Where can I find real-time Ford stock price data?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes.

How does Ford’s electric vehicle strategy impact its stock price?

Investor sentiment towards Ford’s electric vehicle initiatives significantly impacts its stock price. Successful launches and market adoption generally lead to positive price movements.

Monitoring the current Ford Motor stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against other automotive-related investments, such as checking the chervon stock price , which offers a different perspective on the industry’s overall health. Ultimately, understanding the current Ford Motor stock price necessitates a broader view of the automotive sector’s dynamics.

Is Ford stock a good long-term investment?

Whether Ford stock is a good long-term investment depends on individual risk tolerance and investment goals. Thorough research and consideration of various factors are crucial before making any investment decision.