Historical Dow Jones Industrial Average Performance

Dow stock price history – The Dow Jones Industrial Average (DJIA), a stock market index tracking 30 large, publicly-owned companies in the United States, boasts a rich and volatile history reflecting the ebbs and flows of the American, and indeed, the global economy. Its journey, from its inception to its current standing, offers valuable insights into economic trends, investor sentiment, and the enduring power of corporate resilience.

Chronological Overview of Dow Price Movements

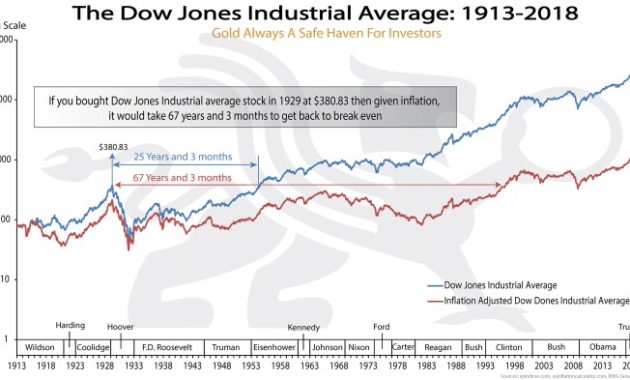

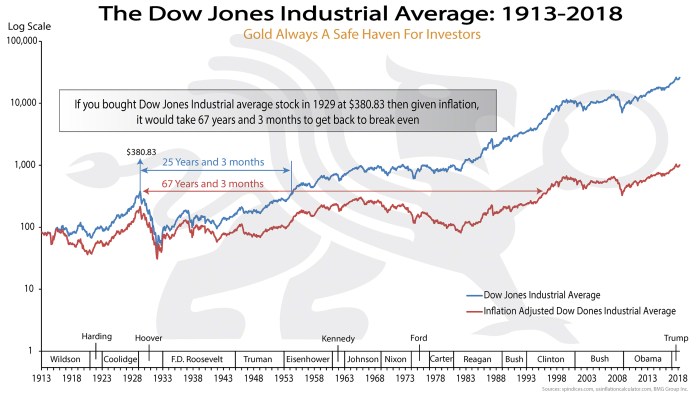

Source: economicgreenfield.com

The Dow’s inception in 1896 saw a starting value significantly lower than today’s figures. Its early years were marked by gradual growth punctuated by periods of stagnation and decline, mirroring the economic realities of the time. The early 20th century witnessed significant fluctuations influenced by events such as World War I and the subsequent economic boom of the roaring twenties.

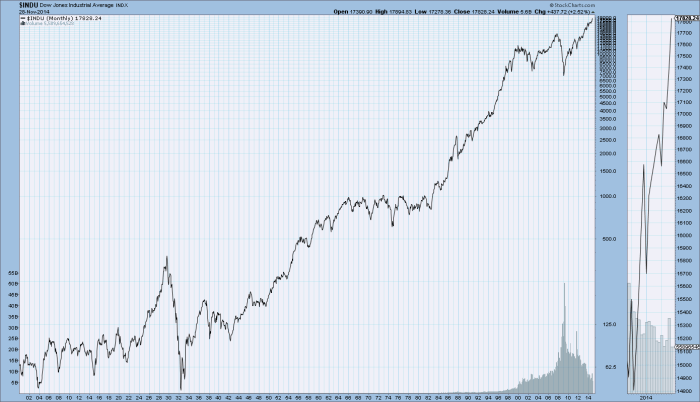

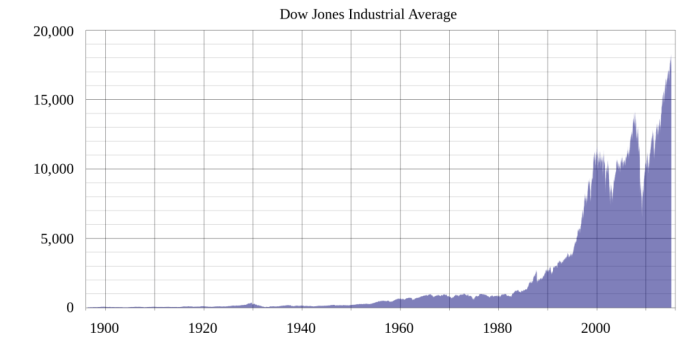

The Great Depression dealt a devastating blow, causing a dramatic plummet in the Dow’s value. Post-war economic growth led to a sustained upward trajectory, albeit with periodic corrections. The latter half of the 20th century saw the Dow experience rapid expansion driven by technological advancements and globalization, followed by the dot-com bubble and its subsequent burst. The 21st century has been characterized by further periods of growth and decline, most notably the 2008 financial crisis and the subsequent recovery, demonstrating the index’s ongoing sensitivity to global economic shifts.

Significant Historical Events and Their Impact

Major historical events have profoundly impacted the Dow’s trajectory. The Great Depression, for instance, saw the Dow plunge by over 89%, reflecting the widespread economic devastation. World War II, while initially causing market uncertainty, eventually fueled post-war economic growth and a subsequent surge in the Dow. The dot-com bubble of the late 1990s and early 2000s, characterized by inflated valuations of technology companies, led to a significant market correction once the bubble burst.

Similarly, the 2008 financial crisis triggered a sharp decline in the Dow, highlighting the interconnectedness of global financial markets.

Dow Performance During Major Economic Periods

| Date Range | Starting Value | Ending Value | Percentage Change |

|---|---|---|---|

| 1929-1932 (Great Depression) | 381.17 | 41.22 | -89.2% |

| 1995-2000 (Dot-com Bubble) | 3833.19 | 11497.12 | 200% |

| 2007-2009 (2008 Financial Crisis) | 14164.53 | 6547.05 | -53.6% |

Factors Influencing Dow Stock Prices

The Dow’s daily, monthly, and yearly fluctuations are influenced by a complex interplay of macroeconomic factors, industry-specific trends, and global events. Understanding these influences is crucial for investors seeking to navigate the market effectively.

Macroeconomic Factors

Source: howthemarketworks.com

Broad economic indicators such as interest rates, inflation, unemployment rates, and consumer confidence significantly impact the Dow. Rising interest rates, for example, can dampen economic growth and reduce corporate profits, potentially leading to a decline in stock prices. High inflation erodes purchasing power and increases uncertainty, often negatively affecting market sentiment. Conversely, low unemployment and strong consumer spending can boost economic growth and drive stock prices higher.

Government fiscal and monetary policies also play a critical role, influencing investor confidence and overall market direction.

Industry-Specific Impacts

The performance of specific sectors within the Dow significantly influences the overall index. The technology sector, for example, often exhibits high volatility and can drive significant swings in the Dow’s value. Similarly, the financial sector’s performance has a considerable impact, given its interconnectedness with the broader economy. The energy sector’s performance is influenced by global commodity prices, and fluctuations in oil prices can significantly affect the Dow’s overall trajectory.

Changes in consumer spending patterns can also significantly impact various sectors and, consequently, the Dow.

Analyzing the Dow stock price history often involves examining individual components’ performance. Understanding the trajectory of major companies is crucial, and a prime example is Dell, whose historical stock price fluctuations can be explored in detail at dell historical stock price. This data provides valuable context when interpreting broader Dow trends, offering insights into sector-specific influences on the overall index.

Domestic vs. International Events, Dow stock price history

Both domestic and international events can significantly influence Dow stock prices. Domestic factors such as political stability, regulatory changes, and economic policies have a direct impact. International events, such as global conflicts, economic crises in major trading partners, and shifts in global trade policies, can also significantly influence investor sentiment and market performance. The interconnected nature of global markets means that events in one region can quickly ripple across the globe, affecting even seemingly unrelated markets.

Dow Stock Price Volatility

Source: bmg-group.com

The Dow’s history is marked by periods of both high and low volatility, reflecting the inherent uncertainty in financial markets. Understanding the causes of these price swings is essential for informed investment decisions.

Periods of High and Low Volatility

Historically, periods of high volatility have often coincided with major economic or geopolitical events, such as wars, recessions, and financial crises. Conversely, periods of low volatility are often associated with sustained economic growth and stability. The level of volatility can also be influenced by investor sentiment and market psychology. For instance, periods of heightened uncertainty can lead to increased volatility, as investors react to news and events with greater sensitivity.

Causes of Significant Price Swings

Significant price swings in the Dow can stem from both predictable and unpredictable events. Predictable events, such as scheduled interest rate announcements or the release of key economic data, can cause short-term fluctuations. Unpredictable events, such as unexpected geopolitical developments or natural disasters, can cause more significant and sudden price swings. Market sentiment, driven by factors such as news reports, analyst opinions, and social media trends, can also contribute to volatility.

Examples of High-Volatility Periods

- The Great Depression (1929-1933): Characterized by widespread economic panic and a dramatic decline in stock prices.

- The 1970s Oil Crisis: Soaring oil prices led to economic uncertainty and market volatility.

- Black Monday (1987): A single-day market crash triggered by a combination of factors, including concerns about rising interest rates and global economic slowdown.

- The Dot-com Bubble Burst (2000-2002): The rapid inflation and subsequent collapse of technology stock valuations led to significant market volatility.

- The 2008 Financial Crisis: The collapse of the housing market and the ensuing global financial crisis triggered a period of extreme market volatility.

- COVID-19 Pandemic (2020): The pandemic’s economic impact and market uncertainty caused significant price swings.

Analyzing Dow Price Trends: Dow Stock Price History

Identifying long-term trends and using technical analysis are crucial for understanding the Dow’s historical price movements and potentially predicting future trends. However, it’s crucial to remember that no method guarantees accurate predictions.

Identifying Long-Term Trends

Long-term trends in the Dow are typically characterized as bull markets (sustained upward trends) or bear markets (sustained downward trends). Bull markets are usually associated with periods of economic expansion and investor optimism, while bear markets often accompany economic contractions and pessimism. Identifying these trends involves analyzing long-term price charts and considering broader economic indicators. The duration of these markets can vary significantly, ranging from several months to several years.

Technical Analysis Methods

Technical analysis utilizes historical price and volume data to predict future price movements. Various methods exist, including moving averages (calculating the average price over a specific period), relative strength index (RSI, measuring the magnitude of recent price changes to evaluate overbought or oversold conditions), and candlestick patterns (interpreting candlestick formations to anticipate price direction). These techniques help identify potential support and resistance levels, predict trend reversals, and assess market momentum.

Comparison of Technical Indicators

Moving averages provide a smoothed representation of price trends, helping identify the overall direction. RSI helps gauge the strength of price movements and identify potential overbought or oversold conditions. While these indicators can be useful, they should be used in conjunction with other analytical tools and fundamental analysis, rather than as standalone predictive measures. The effectiveness of any technical indicator can vary depending on market conditions and the specific timeframe being analyzed.

False signals are possible, and relying solely on technical analysis can be risky.

Visual Representation of Dow Stock Price History

Visual representations, such as line graphs and bar charts, offer a clear and concise way to understand the Dow’s historical performance. These visualizations highlight key turning points and provide a context for understanding long-term trends.

Hypothetical Line Graph

A hypothetical line graph illustrating the Dow’s price history would have “Years” on the x-axis and “Dow Jones Industrial Average Value” on the y-axis. The line itself would represent the Dow’s price over time. Key turning points, such as the start and end of bull and bear markets, major economic events (e.g., the Great Depression, the dot-com bubble, the 2008 financial crisis), and periods of high volatility, would be clearly marked on the graph.

The graph would visually demonstrate the Dow’s long-term growth trajectory, interspersed with periods of significant price fluctuations.

Hypothetical Bar Chart

A hypothetical bar chart comparing the Dow’s annual performance over the past 50 years would have “Year” on the x-axis and “Percentage Change” on the y-axis. Each bar would represent a single year, with its height corresponding to the percentage change in the Dow’s value from the beginning to the end of that year. This chart would provide a clear visual representation of the Dow’s annual performance, allowing for easy comparison of growth and decline across different years.

Significant events influencing annual performance could be annotated on the chart.

Impact of Specific Companies on the Dow

The Dow Jones Industrial Average is a composite index, and the performance of individual companies within the index significantly influences its overall value. Understanding the impact of specific companies helps in comprehending the broader market dynamics.

Historical Influence of Individual Companies

Throughout history, several companies listed in the Dow have exerted a disproportionate influence on the index’s performance. Companies with large market capitalizations naturally have a greater impact. For example, technology giants like Microsoft and Apple have, at various times, driven significant upward movements in the Dow. Conversely, periods of underperformance by major financial institutions have often contributed to market downturns.

The influence of a company on the Dow is also affected by its sector’s performance and overall market sentiment.

Examples of Significant Company Impacts

IBM’s dominance in the technology sector for much of the 20th century significantly influenced the Dow. Similarly, the rapid growth of technology companies in the late 1990s contributed to the dot-com bubble and subsequent crash. Conversely, the financial crisis of 2008 saw major financial institutions suffer significant losses, impacting the Dow considerably. The rise and fall of specific companies often reflects broader economic trends and technological shifts.

Hypothetical Scenario of Single Company Impact

Imagine a hypothetical scenario where a company like Apple, a major component of the Dow, experiences a sudden and dramatic decline in its stock price due to, for instance, a major product recall or unexpected regulatory action. This decline would likely trigger a significant drop in the Dow’s overall value, potentially triggering a broader market sell-off as investors react to the news and reassess their risk appetite.

The magnitude of the impact would depend on the size of the decline in Apple’s stock price and the overall market sentiment at the time.

FAQ Insights

What is the significance of the Dow Jones Industrial Average?

The Dow Jones Industrial Average (DJIA) is a widely-used stock market index that tracks the performance of 30 large, publicly-owned companies in the United States. It’s a key indicator of overall market health and investor sentiment.

How often is the Dow Jones Industrial Average updated?

The Dow Jones Industrial Average is updated in real-time throughout the trading day, reflecting the current prices of its component stocks.

Where can I find reliable historical Dow data?

Reliable historical Dow data can be found on various financial websites such as Yahoo Finance, Google Finance, and Bloomberg.

Are there any books or resources that provide in-depth analysis of Dow stock price history?

Yes, numerous books and academic papers provide detailed analyses of the Dow’s historical performance. Searching for “Dow Jones Industrial Average history” in academic databases or online bookstores will yield many results.