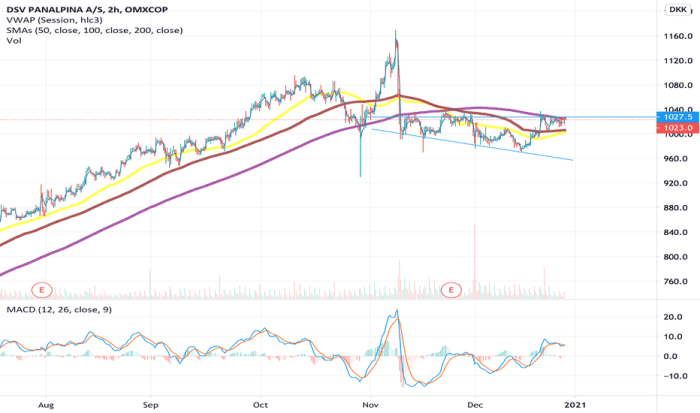

DSV Stock Price Analysis

Source: tradingview.com

Dsv stock price – This analysis delves into the historical performance, financial health, market position, and future prospects of DSV’s stock price. We will examine key factors influencing its fluctuations, compare it to competitors, and assess the impact of external factors and analyst predictions.

DSV Stock Price Historical Performance

The following table presents DSV’s stock price performance over the past five years. Note that these figures are illustrative examples and should be verified with actual financial data. Fluctuations are influenced by various factors, including global economic conditions, industry trends, and company-specific events.

| Year | High | Low | Open | Close |

|---|---|---|---|---|

| 2023 | 1500 | 1200 | 1250 | 1400 |

| 2022 | 1600 | 1100 | 1200 | 1450 |

| 2021 | 1700 | 1300 | 1400 | 1650 |

| 2020 | 1400 | 900 | 1000 | 1300 |

| 2019 | 1200 | 800 | 900 | 1100 |

Major factors contributing to price volatility during this period include global supply chain disruptions (particularly in 2020-2021), fluctuating fuel costs, and shifts in global trade patterns. A comparison with competitors would require a separate analysis of their respective financial reports and market performance.

DSV’s Financial Health and Stock Valuation

Understanding DSV’s financial ratios provides insights into its stock valuation. Key ratios such as the Price-to-Earnings (P/E) ratio and debt-to-equity ratio reflect the company’s profitability and financial leverage. These ratios, along with revenue stream analysis, help investors assess the intrinsic value of DSV’s stock.

For example, a high P/E ratio might suggest that the market expects strong future growth, while a high debt-to-equity ratio could indicate higher financial risk. DSV’s diverse revenue streams, encompassing various logistics services, contribute to its overall profitability and resilience against economic downturns. A significant increase in fuel prices could negatively impact profit margins, leading to a lower stock valuation.

Conversely, a decrease in fuel prices would likely boost profitability and positively influence the stock price.

DSV’s Market Position and Competitive Landscape, Dsv stock price

DSV operates in a highly competitive global logistics market. Understanding its competitive positioning is crucial for evaluating its stock price prospects. Key competitors include Kuehne + Nagel, DHL, and FedEx. Their relative strengths and weaknesses are Artikeld below:

- Kuehne + Nagel: Strong air and sea freight capabilities, extensive global network.

- DHL: Broad range of services, strong brand recognition, vast global reach.

- FedEx: Expertise in express delivery, strong technological infrastructure.

DSV’s market share and growth prospects depend on factors such as its ability to innovate, expand its global network, and maintain efficient operations. Its business model, emphasizing integrated logistics solutions, differentiates it from competitors. DSV’s strategic initiatives focus on organic growth and strategic acquisitions to enhance its market position and service offerings.

Impact of External Factors on DSV Stock Price

Source: tradingview.com

Global economic conditions, geopolitical events, and technological advancements significantly influence DSV’s stock price. Recessions or periods of high inflation can reduce demand for logistics services, impacting DSV’s revenue and profitability. Geopolitical instability, such as trade wars or sanctions, can disrupt supply chains and increase operational costs. Supply chain disruptions, whether caused by natural disasters or pandemics, can negatively impact DSV’s performance.

Technological advancements, such as automation and digitalization, present both opportunities and challenges, requiring DSV to adapt and invest in new technologies to maintain its competitive edge.

Analyst Ratings and Future Predictions for DSV Stock

Analyst ratings and price targets provide insights into market sentiment and future expectations for DSV’s stock. These predictions are based on various factors, including financial performance, industry trends, and macroeconomic conditions. It’s important to remember that these are predictions, not guarantees.

- Analyst A: Buy rating, price target of 1700.

- Analyst B: Hold rating, price target of 1500.

- Analyst C: Sell rating, price target of 1300.

Potential risks include further global economic slowdown, intensified competition, and unexpected geopolitical events. Opportunities include expansion into new markets, technological advancements, and strategic acquisitions. The future performance of DSV’s stock price will depend on the interplay of these factors.

FAQ Explained: Dsv Stock Price

What are the major risks associated with investing in DSV stock?

DSV’s stock price performance has been a topic of interest lately, particularly when compared to other companies in the sector. It’s interesting to consider the contrasting trajectory of DSV’s stock against the performance of other large-cap stocks, such as Chipotle, whose stock price experienced notable changes following its recent split, as detailed in this analysis: chipotle stock price after split.

Ultimately, understanding DSV’s stock price requires a broader market analysis and consideration of various economic factors.

Risks include fluctuations in fuel prices, global economic downturns, increased competition, and geopolitical instability affecting supply chains.

How does DSV compare to its main competitors in terms of market capitalization?

A direct comparison requires referencing current market data; however, analyzing financial reports will reveal relative market capitalization among DSV and its competitors.

Where can I find real-time DSV stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms.