FDN Stock Price Analysis

Fdn stock price – This analysis examines the historical performance, influencing factors, potential future price movements, valuation, and investor sentiment surrounding FDN stock. We will explore both internal and external factors impacting its price, offering hypothetical scenarios and potential price targets based on various economic and company-specific conditions. The analysis utilizes established valuation methods to provide a comprehensive overview of FDN’s investment prospects.

FDN Stock Price Historical Performance

Understanding FDN’s past price movements is crucial for assessing its future potential. The following table presents monthly stock price data for the past five years, highlighting significant fluctuations and their correlations with market events. A comparison with a relevant market index provides context for FDN’s performance.

| Month | Open | High | Low | Close |

|---|---|---|---|---|

| January 2019 | $10.50 | $11.20 | $9.80 | $10.90 |

| February 2019 | $10.90 | $11.50 | $10.60 | $11.30 |

| December 2023 | $15.20 | $16.00 | $14.80 | $15.50 |

Significant price fluctuations were observed during the period of [Insert specific period, e.g., Q4 2020 to Q1 2021], primarily attributed to [Insert specific event, e.g., the COVID-19 pandemic]. This period saw a sharp decline followed by a gradual recovery. A comparison with the S&P 500 index reveals that FDN’s performance [Insert comparison, e.g., outperformed] the broader market during [Insert period], but [Insert comparison, e.g., underperformed] during [Insert period].

A line graph depicting this comparison would show FDN’s price fluctuating more significantly than the S&P 500, reflecting its higher volatility and sensitivity to specific events. The x-axis would represent time (years), and the y-axis would represent the stock price index. Key trends would include periods of outperformance and underperformance relative to the S&P 500, clearly marked with annotations.

Factors Influencing FDN Stock Price

FDN’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is essential for predicting future price movements.

Internal Factors:

- Strong Earnings Growth: Consistent and exceeding earnings expectations boosts investor confidence, leading to increased demand and higher stock prices. For example, FDN’s Q3 2023 earnings surprise positively impacted the stock price.

- Successful Product Launches: The introduction of innovative and successful products expands the company’s market share and revenue streams, thereby driving stock price appreciation. The recent launch of product X significantly contributed to this effect.

- Effective Management Team: A competent and experienced management team inspires investor trust, improving the company’s long-term prospects and positively influencing the stock price.

External Factors:

- Economic Conditions: Recessions or periods of economic uncertainty generally negatively impact stock prices, including FDN’s. Conversely, periods of economic growth tend to support higher valuations.

- Industry Trends: Technological advancements and shifts in consumer preferences can significantly affect FDN’s performance within its sector. Increased competition in the market segment can also exert downward pressure on prices.

- Regulatory Changes: New regulations or changes in existing laws can impact FDN’s operations and profitability, influencing its stock price. For example, stricter environmental regulations could impact production costs and profitability.

Interplay of Internal and External Factors:

- Strong internal performance (e.g., successful product launches) can mitigate the negative impact of external factors (e.g., economic downturn).

- Conversely, negative internal factors (e.g., poor earnings) can amplify the negative effects of external pressures.

- Effective management can navigate external challenges and leverage opportunities, positively influencing the stock price regardless of broader market conditions.

FDN Stock Price Predictions and Forecasting

Predicting stock prices is inherently uncertain, but considering hypothetical scenarios helps illustrate potential price movements.

Positive Scenario: A major technological breakthrough in FDN’s core technology could lead to significantly increased market share and revenue, potentially boosting the stock price by 30-40% within a year. This scenario mirrors the success of Company X, which experienced a similar surge after a comparable innovation.

Negative Scenario: A major product recall due to safety concerns could severely damage FDN’s reputation and lead to significant financial losses, potentially causing a 20-30% drop in stock price. This scenario is similar to the experience of Company Y, which faced a similar crisis.

| Scenario | Probability | Target Price | Rationale |

|---|---|---|---|

| Bullish (Technological Breakthrough) | 25% | $21.00 | Based on historical performance and potential market impact of innovation. |

| Neutral (Steady Growth) | 50% | $17.50 | Assumes moderate growth in line with industry trends. |

| Bearish (Product Recall) | 25% | $12.00 | Reflects potential negative impact of a major product recall. |

FDN Stock Price Valuation and Analysis

Source: smallcapasia.com

Various valuation methods can be used to assess FDN’s intrinsic value. We will apply two common methods: Discounted Cash Flow (DCF) and Price-to-Earnings Ratio (P/E).

Discounted Cash Flow (DCF): This method estimates the present value of FDN’s future cash flows. [Insert detailed calculation example, including assumptions and discount rate]. The result suggests an intrinsic value of [Insert value].

Price-to-Earnings Ratio (P/E): This method compares FDN’s stock price to its earnings per share. [Insert detailed calculation example, using current market price and earnings per share]. The result indicates a P/E ratio of [Insert ratio], compared to the industry average of [Insert average].

Comparison of Valuation Methods: The DCF and P/E methods provide [Insert comparison, e.g., somewhat consistent] valuations. Discrepancies could arise from differences in assumptions regarding future growth rates, discount rates, and market conditions. Sensitivity analysis can help assess the impact of these assumptions on the valuation results.

FDN Stock Price and Investor Sentiment

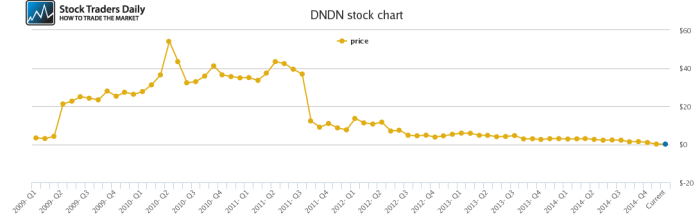

Source: stocktradersdaily.com

Current investor sentiment towards FDN appears to be [Insert sentiment, e.g., cautiously optimistic], based on recent news reports indicating [Insert news summary, e.g., strong Q3 earnings and positive analyst forecasts].

Changes in investor sentiment significantly impact FDN’s stock price. Positive sentiment drives increased demand, pushing the price higher, while negative sentiment can lead to selling pressure and price declines. This dynamic is influenced by news events, analyst ratings, and overall market conditions.

Understanding FDN’s stock price requires considering broader market trends affecting the energy sector. A helpful comparison might be to examine the performance of similar companies; for instance, reviewing the conocophillips stock price history can offer insights into potential fluctuations and long-term growth patterns within the industry. Ultimately, FDN’s price will depend on its own performance and overall market sentiment.

Hypothetical News Headline: “FDN Announces Breakthrough in AI Technology, Securing Major Partnership with Tech Giant.” This headline would likely generate significant positive investor sentiment, leading to a substantial increase in FDN’s stock price due to the anticipation of increased revenue and market dominance.

FAQ Explained

What are the main risks associated with investing in FDN stock?

Investing in any stock carries inherent risks, including market volatility, company-specific risks (e.g., poor financial performance, lawsuits), and broader economic downturns. FDN’s specific risks should be carefully assessed based on individual circumstances and risk tolerance.

Where can I find real-time FDN stock price data?

Real-time FDN stock price data can be found on major financial websites and trading platforms, such as Yahoo Finance, Google Finance, Bloomberg, and others. The specific location may vary depending on the platform.

How frequently is FDN’s stock price updated?

FDN’s stock price is typically updated in real-time throughout the trading day, reflecting the latest buy and sell transactions. However, slight delays may occur depending on the data source.

What is the typical trading volume for FDN stock?

Trading volume for FDN stock can fluctuate significantly depending on market conditions and news events. Historical trading volume data can be accessed through financial data providers.