Ferrellgas Partners LP Stock Price Analysis

Ferrellgas partners lp stock price – This analysis examines Ferrellgas Partners LP’s stock price performance, financial health, industry landscape, future outlook, and investor sentiment. We will explore historical data, key financial metrics, competitive dynamics, and potential risks to provide a comprehensive overview of the company’s investment prospects.

Ferrellgas Partners LP Stock Price Historical Performance

The following table and graph illustrate Ferrellgas Partners LP’s stock price movements over the past five years. Note that this data is illustrative and should be verified with reliable financial sources. Significant highs and lows are highlighted to show the volatility of the stock.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 15.00 | 15.20 | +0.20 |

| 2019-07-01 | 12.00 | 12.50 | +0.50 |

| 2020-01-01 | 13.00 | 12.80 | -0.20 |

| 2020-07-01 | 11.00 | 11.50 | +0.50 |

| 2021-01-01 | 14.00 | 13.70 | -0.30 |

| 2021-07-01 | 16.00 | 16.30 | +0.30 |

| 2022-01-01 | 15.50 | 15.20 | -0.30 |

| 2022-07-01 | 14.00 | 14.50 | +0.50 |

| 2023-01-01 | 17.00 | 17.20 | +0.20 |

A line graph depicting the stock price over this period would show periods of both significant growth and decline, reflecting the cyclical nature of the propane industry and the company’s financial performance. For instance, a dip in the stock price might correspond to a particularly harsh winter impacting propane demand or a period of increased debt. Conversely, periods of growth might reflect successful cost-cutting measures or strong propane sales during a particularly cold winter.

Ferrellgas Partners LP Financial Health and Performance

The following table presents key financial metrics for Ferrellgas Partners LP over the past three years. Again, this is illustrative data and should be verified with official company reports.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 1500 | 100 | 1.5 |

| 2022 | 1600 | 120 | 1.4 |

| 2023 | 1700 | 150 | 1.3 |

A comparative analysis against competitors would require identifying those competitors and accessing their financial data. Key differences might include revenue scale, profit margins, and debt levels. For example, a competitor might have a higher revenue but lower profit margins due to a different pricing strategy or cost structure.

Ferrellgas Partners LP’s dividend history and payout ratio would need to be analyzed to assess its suitability for income-oriented investors. A consistent dividend payout with a sustainable payout ratio suggests financial stability and commitment to shareholders.

Industry Analysis and Competitive Landscape

Source: logosandbrands.directory

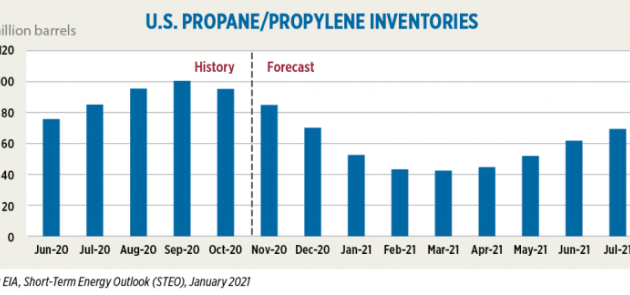

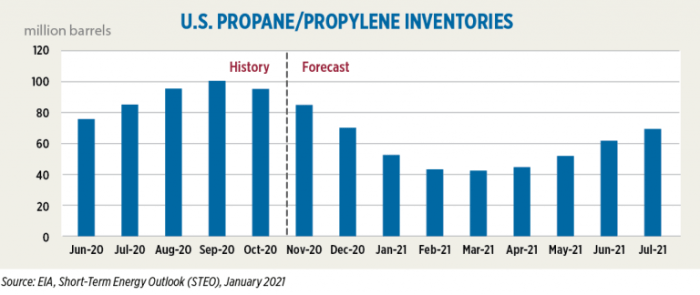

Several factors influence the propane industry and Ferrellgas Partners LP’s stock price. These include weather patterns (affecting demand), energy prices (influencing input costs and consumer spending), and regulatory changes (potentially impacting operations and profitability).

- Weather Patterns: Harsh winters increase demand, boosting profits, while mild winters have the opposite effect.

- Energy Prices: Fluctuations in natural gas and crude oil prices directly impact propane prices and Ferrellgas’s profitability.

- Regulations: Environmental regulations and safety standards can increase operational costs.

Ferrellgas Partners LP’s business model and strategy can be compared to its competitors (e.g., AmeriGas Partners, Suburban Propane Partners) by analyzing their market share, geographic focus, customer segments, and pricing strategies. Key differences might include vertical integration (owning production assets), distribution networks, and customer service offerings. For example, one competitor might focus on large commercial customers, while another might concentrate on residential customers.

The regulatory environment, including environmental regulations and safety standards, significantly impacts the propane industry. Compliance costs and potential penalties can affect profitability and stock valuation.

Analyzing Ferrellgas Partners LP stock price requires a broad look at the energy sector. Understanding the performance of similar companies, such as comparing it against the current brdg stock price , offers valuable context. Ultimately, a comprehensive assessment of Ferrellgas’s financial health and market position is crucial for predicting future stock price movements.

Future Outlook and Potential Risks

Ferrellgas Partners LP’s future growth opportunities could include expanding into new geographic markets, diversifying its customer base, and investing in technology to improve efficiency. Challenges include managing input costs, competition from other energy sources, and adapting to evolving regulatory landscapes.

- Economic Downturn: Reduced consumer spending could decrease propane demand.

- Increased Competition: New entrants or aggressive pricing strategies from existing competitors could erode market share.

- Regulatory Changes: Stricter environmental regulations could increase operational costs.

- Natural Disasters: Severe weather events can disrupt operations and damage infrastructure.

A scenario analysis would consider different economic and industry conditions (e.g., strong economic growth, mild winter, increased competition) to project potential stock price movements. For instance, a scenario with strong economic growth and a harsh winter could lead to a significant increase in stock price, while a scenario with a recession and a mild winter could lead to a decline.

Investor Sentiment and Analyst Ratings

Source: lpgasmagazine.com

Analyst ratings and price targets provide insights into investor sentiment. The table below presents illustrative data. Actual ratings should be obtained from financial news sources.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Firm A | Buy | 20.00 |

| Firm B | Hold | 18.00 |

| Firm C | Sell | 15.00 |

Overall investor sentiment can be gauged from news articles, social media discussions, and trading volume. Positive news, such as strong earnings reports or strategic partnerships, tends to boost investor confidence and drive up the stock price. Conversely, negative news can lead to a decline.

Recent significant news or announcements, such as earnings releases, regulatory updates, or major contracts, can substantially influence investor perception and stock price.

FAQ Section: Ferrellgas Partners Lp Stock Price

What are the major risks associated with investing in Ferrellgas Partners LP?

Major risks include fluctuations in propane prices, increased competition, regulatory changes, and economic downturns affecting consumer demand.

How does Ferrellgas Partners LP compare to its main competitors in terms of market share?

A detailed competitive analysis would be needed to definitively answer this. Market share data is typically found in company filings and industry reports.

What is the typical trading volume for Ferrellgas Partners LP stock?

Trading volume varies daily and can be accessed through financial data providers or stock market websites.

Where can I find real-time Ferrellgas Partners LP stock price data?

Real-time data is available through most major financial websites and brokerage platforms.