Fidelity Balanced Fund: A Comprehensive Analysis

Fidelity balanced fund stock price – The Fidelity Balanced Fund is a popular choice for investors seeking a blend of growth and stability. This article delves into the fund’s investment strategy, historical performance, and future outlook, providing a comprehensive analysis to aid investment decisions.

Fidelity Balanced Fund Overview

The Fidelity Balanced Fund employs a diversified investment strategy, aiming to balance growth potential with capital preservation. The fund managers actively manage the portfolio, adjusting asset allocation based on market conditions and long-term economic forecasts. Historically, the fund has demonstrated a mix of high and low returns, reflecting the inherent volatility of the market. The asset allocation typically includes a significant portion in stocks (equities), providing growth potential, and a substantial portion in bonds (fixed income), offering stability and income generation.

A smaller portion may be allocated to other asset classes, depending on the fund manager’s assessment of market opportunities and risks.

A typical asset allocation might include approximately 60% stocks, 35% bonds, and 5% other assets; however, this can fluctuate. The fund’s historical performance has varied, reflecting both strong bull markets and periods of economic uncertainty. During periods of market growth, the fund’s returns have generally outperformed less diversified investment strategies. Conversely, during market downturns, the bond component has helped to cushion the impact on the overall portfolio value.

| Expense Ratio | Minimum Investment | Investment Type | Fund Manager |

|---|---|---|---|

| 0.45% (Illustrative) | $2,500 (Illustrative) | Balanced | [Insert Fund Manager Name Here] |

Factors Influencing Stock Price

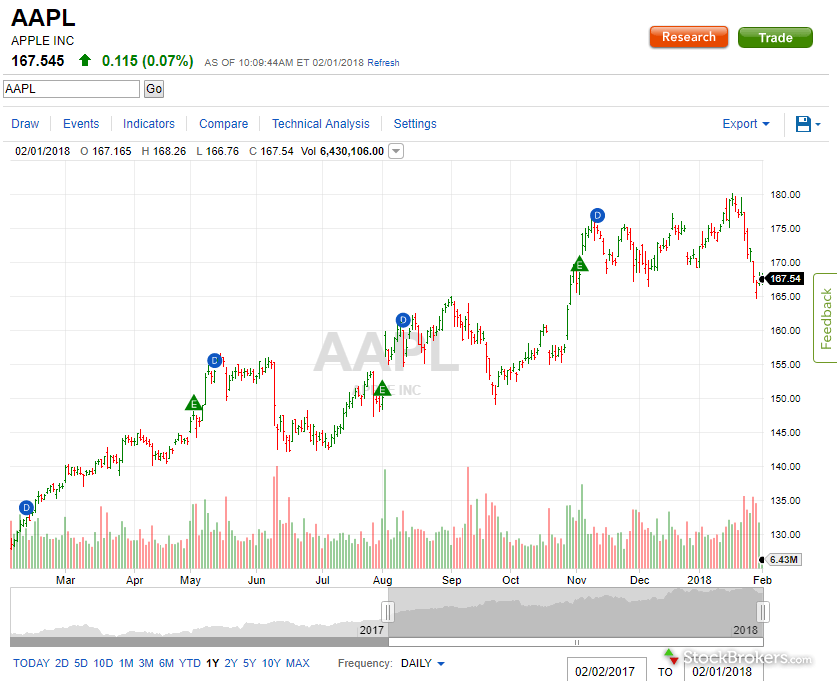

Source: stockbrokers.com

Several macroeconomic factors significantly impact the Fidelity Balanced Fund’s stock price. Interest rate changes, for instance, affect both the bond and stock components of the fund. Rising interest rates generally put downward pressure on bond prices, while their effect on stock prices is more complex, often depending on the overall economic climate and the specific sectors within the stock market.

Market volatility and investor sentiment play a crucial role. Periods of high volatility tend to decrease the fund’s price, as investors become risk-averse. Conversely, positive investor sentiment often leads to higher prices. The fund’s performance is also compared to similar balanced funds. Benchmarks such as other balanced mutual funds with similar investment strategies are used to assess relative performance.

Analyzing Historical Data

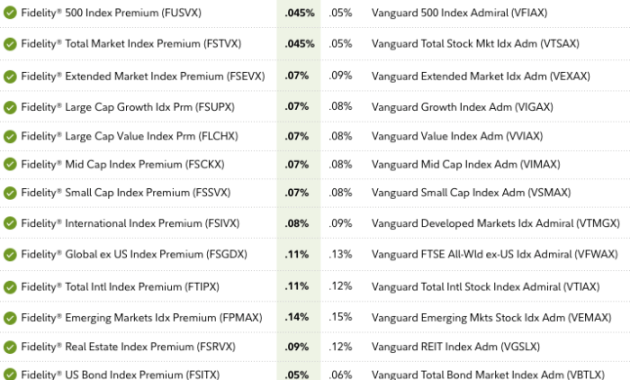

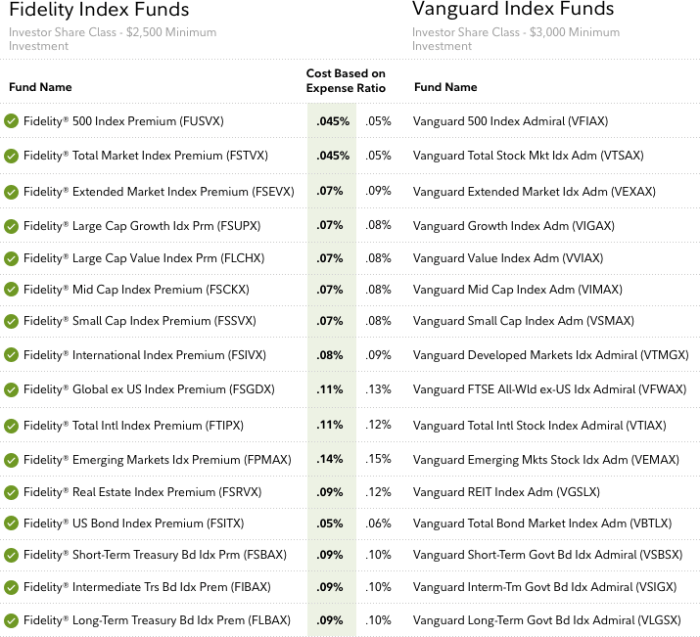

Source: fidelity.com

Over the past five years, the Fidelity Balanced Fund’s stock price has exhibited a pattern of growth punctuated by periods of correction. The line graph below visually depicts this trend. The graph shows a clear correlation between the fund’s price and major market events, such as the 2020 market crash due to the COVID-19 pandemic and subsequent recovery.

Line Graph Caption: The graph illustrates the Fidelity Balanced Fund’s stock price fluctuations over the past five years. Note the significant dip in early 2020, corresponding to the COVID-19 market downturn, followed by a strong recovery. The graph also shows periods of consolidation and more moderate growth throughout the five-year period.

| Date | Price | Market Condition | Significant Event |

|---|---|---|---|

| December 31, 2018 | [Insert Price] | Bear Market | [Insert Relevant Event] |

| December 31, 2019 | [Insert Price] | Bull Market | [Insert Relevant Event] |

| December 31, 2020 | [Insert Price] | Recovery | COVID-19 Pandemic Impact |

| December 31, 2021 | [Insert Price] | Bull Market | [Insert Relevant Event] |

| December 31, 2022 | [Insert Price] | Bear Market | [Insert Relevant Event] |

Risk and Return Considerations

Investing in the Fidelity Balanced Fund carries a moderate level of risk. While the diversification strategy aims to mitigate risk, fluctuations in both stock and bond markets can impact the fund’s value. The fund’s risk-adjusted return is generally considered competitive compared to similar balanced funds and other investment options. Conservative investors might find the fund suitable, while more aggressive investors may prefer higher-risk, higher-return alternatives.

- Market Risk: Fluctuations in overall market conditions.

- Interest Rate Risk: Changes in interest rates affecting bond prices.

- Inflation Risk: Erosion of purchasing power due to inflation.

- Reinvestment Risk: Difficulty reinvesting income at comparable rates.

Future Outlook and Projections, Fidelity balanced fund stock price

The future performance of the Fidelity Balanced Fund depends on various factors, including economic growth, inflation rates, and geopolitical events. The fund manager’s outlook, along with expert opinions, suggests a cautiously optimistic view for the coming year. However, it is important to note that these are projections and not guarantees.

| Scenario | Annual Return (%) | Probability | Underlying Conditions |

|---|---|---|---|

| Optimistic | 8-10% | 30% | Strong economic growth, low inflation |

| Moderate | 5-7% | 50% | Moderate economic growth, stable inflation |

| Pessimistic | 2-4% | 20% | Slow economic growth, high inflation |

Common Queries: Fidelity Balanced Fund Stock Price

What is the minimum investment required for the Fidelity Balanced Fund?

The minimum investment amount varies depending on the investment account type. It’s best to check Fidelity’s website for the most up-to-date information.

How frequently is the Fidelity Balanced Fund’s net asset value (NAV) calculated?

The NAV is typically calculated daily, reflecting the closing market prices of the underlying assets.

Where can I find real-time pricing information for the Fidelity Balanced Fund?

Real-time pricing information is usually available on Fidelity’s website and through various financial data providers.

Understanding the Fidelity Balanced Fund stock price often involves considering its diverse holdings. A key component of such analysis might include assessing the performance of individual stocks within the fund, such as the impact of the cummins engine stock price on the overall fund value. Therefore, tracking the price movements of major holdings, like Cummins, provides valuable insight into the Fidelity Balanced Fund’s potential performance.

Are there any transaction fees associated with buying or selling shares of the Fidelity Balanced Fund?

Transaction fees may apply depending on your account type and the method of purchase. Consult Fidelity’s fee schedule for details.