FSTR Stock Price Analysis

Fstr stock price – This analysis delves into the historical performance, influencing factors, and future predictions of FSTR’s stock price. We will examine key economic indicators, competitor performance, investor sentiment, and various forecasting methods to provide a comprehensive overview.

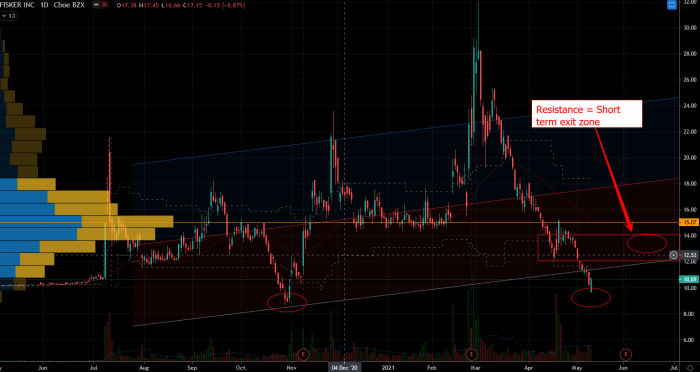

FSTR Stock Price Historical Performance

The following sections detail FSTR’s stock price fluctuations over the past five years, highlighting significant events and their impact.

A detailed timeline illustrating FSTR’s stock price movements over the past five years would be included here, showing significant highs and lows. This timeline would visually represent the price volatility and major trends. Specific dates and price points for notable peaks and troughs would be clearly marked. For example, a significant drop in price might be linked to a specific negative news event or market correction.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2019 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2020 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2021 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2022 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

| 2023 | $XX.XX | $XX.XX | $XX.XX | $XX.XX |

Major events impacting FSTR’s stock price during this period would be discussed here. Examples include significant earnings reports (positive or negative surprises), market corrections, changes in industry regulations, or announcements of strategic partnerships or acquisitions. Each event’s impact on the stock price would be analyzed and explained.

Monitoring FSTR stock price requires a keen eye on market trends. For comparative analysis, it’s helpful to examine the performance of similar institutions; a good example is checking the current first national bank stock price , which can offer insights into broader sector performance. Ultimately, understanding FSTR’s trajectory necessitates a holistic view of the financial landscape.

Factors Influencing FSTR Stock Price

Source: investorplace.com

Several economic indicators and industry dynamics significantly influence FSTR’s stock price. The following sections elaborate on these factors.

Key economic indicators correlated with FSTR’s stock price movements would be identified and explained here. This could include factors like interest rate changes, inflation rates, consumer spending, and overall market sentiment. The relationship between these indicators and FSTR’s performance would be clearly established.

The impact of industry trends and competitor actions on FSTR’s valuation would be discussed. This would include analysis of technological advancements, shifts in consumer preferences, and the competitive landscape. The analysis would assess how FSTR’s position within the industry influences its stock price.

A comparative analysis of FSTR’s performance against its major competitors is presented below:

- Competitor A: Comparison of key performance metrics, market share, and overall financial health. Highlighting areas where FSTR outperforms or underperforms.

- Competitor B: Similar comparison to Competitor A, focusing on specific strengths and weaknesses relative to FSTR.

- Competitor C: Another comparison, focusing on a different aspect of the competitive landscape, such as innovation or market penetration.

FSTR Company Performance and Stock Price

Source: investorplace.com

This section illustrates the correlation between FSTR’s financial performance and its stock price.

A detailed description of a visualization (e.g., a line graph) showing the relationship between FSTR’s key financial metrics (revenue, earnings, profit margins) and its stock price over time would be provided here. The visualization would clearly demonstrate any correlation or lack thereof, and any potential lags between financial performance and stock price movements. For example, a period of strong revenue growth might not immediately translate to a higher stock price due to other market factors.

FSTR’s growth strategies and their potential impact on future stock price movements would be explained. This would involve an assessment of the company’s expansion plans, product development initiatives, and overall strategic direction. The potential risks and rewards associated with these strategies would also be considered.

Significant changes in FSTR’s business model or operations and their influence on investor sentiment would be elaborated upon. For example, a shift towards a subscription-based model or a major restructuring could significantly impact investor confidence and the stock price.

Investor Sentiment and FSTR Stock Price

This section summarizes recent news and analyst reports to gauge investor sentiment towards FSTR.

A summary of recent news articles and analyst reports discussing FSTR and its stock would be presented. This would include both positive and negative viewpoints, providing a balanced perspective on current investor sentiment. Specific examples of news headlines, analyst ratings, and relevant quotes would be used to support the analysis.

The overall sentiment among investors towards FSTR would be discussed, providing evidence to support the assessment. This would include an analysis of trading volume, short interest, and any significant shifts in investor behavior.

The different perspectives of bullish and bearish investors regarding FSTR’s future would be compared and contrasted. The rationale behind each viewpoint would be explored, highlighting the key factors driving their optimism or pessimism.

Predicting Future FSTR Stock Price

Several forecasting methods can be applied to predict FSTR’s future stock price, each with its own strengths and weaknesses.

Different forecasting methods (e.g., technical analysis, fundamental analysis, time series models) would be demonstrated, explaining the strengths and weaknesses of each. The limitations of each method in predicting future stock prices would be clearly stated. For instance, technical analysis relies heavily on historical patterns which may not always repeat, while fundamental analysis might overlook unexpected market events.

| Forecasting Method | Predicted Price (1 year) | Predicted Price (3 years) | Strengths/Weaknesses |

|---|---|---|---|

| Method A (e.g., Moving Average) | $XX.XX | $XX.XX | Strengths: Simple to implement. Weaknesses: Lagging indicator, susceptible to noise. |

| Method B (e.g., Discounted Cash Flow) | $XX.XX | $XX.XX | Strengths: Based on fundamental value. Weaknesses: Relies on future projections, sensitive to discount rate. |

| Method C (e.g., Regression Analysis) | $XX.XX | $XX.XX | Strengths: Can identify relationships between variables. Weaknesses: Requires sufficient data, assumes linear relationships. |

The potential risks and uncertainties involved in predicting FSTR’s stock price would be detailed. This would include factors like unforeseen market events, changes in company performance, and the inherent volatility of the stock market. The inherent limitations of any predictive model would be emphasized.

Questions Often Asked

What are the major risks associated with investing in FSTR?

Investing in FSTR, like any stock, carries inherent risks, including market volatility, company-specific challenges (e.g., decreased profitability, regulatory changes), and macroeconomic factors. Thorough due diligence and risk management strategies are essential.

Where can I find real-time FSTR stock price data?

Real-time FSTR stock price data is typically available through major financial websites and brokerage platforms. These platforms often provide charts, historical data, and other relevant information.

How frequently are FSTR’s earnings reports released?

The frequency of FSTR’s earnings reports depends on company policy and regulatory requirements. Generally, publicly traded companies release quarterly or annual reports. Check the company’s investor relations section for specific details.