GGLL Stock Price Analysis

Ggll stock price – This analysis delves into the historical performance, key influencers, valuation, investor sentiment, and technical aspects of GGLL stock, providing insights for potential investors. The information presented here is for informational purposes only and does not constitute financial advice.

GGLL Stock Price Historical Performance

Understanding GGLL’s past price movements is crucial for assessing its potential future trajectory. The following table details the stock’s performance over the past five years, highlighting significant highs and lows. Note that this data is hypothetical for illustrative purposes.

Tracking GGLL stock price requires diligence, as market fluctuations are common. Understanding comparable companies’ performance can provide context; for instance, checking the current byrna gun stock price offers a glimpse into a different sector’s volatility. Ultimately, though, thorough GGLL research remains crucial for informed investment decisions.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 100,000 |

| 2019-07-01 | 12.00 | 11.80 | 150,000 |

| 2020-01-01 | 11.50 | 13.00 | 200,000 |

| 2020-07-01 | 12.50 | 14.00 | 250,000 |

| 2021-01-01 | 14.20 | 15.00 | 300,000 |

| 2021-07-01 | 16.00 | 15.50 | 280,000 |

| 2022-01-01 | 15.00 | 17.00 | 350,000 |

| 2022-07-01 | 16.50 | 18.00 | 400,000 |

| 2023-01-01 | 17.80 | 19.00 | 450,000 |

Major events impacting GGLL’s stock price during this period include:

- Strong Q4 2020 earnings exceeding analyst expectations, leading to a significant price surge.

- A market correction in early 2022 negatively impacting the stock price, despite positive company performance.

- Successful product launch in mid-2022 boosting investor confidence and driving price increases.

A comparative line graph illustrating GGLL’s performance against its competitors (hypothetical data for illustration) would show GGLL’s stock price fluctuating more dramatically than its competitors, exhibiting higher volatility but also higher growth potential during certain periods. The graph would display GGLL’s price alongside those of three competitors, each represented by a different colored line. The x-axis would represent time (five years), and the y-axis would represent the stock price.

GGLL Stock Price Drivers and Influencers

Several factors contribute to GGLL’s stock price fluctuations.

- Company Performance: Earnings reports, revenue growth, and new product launches significantly influence investor sentiment.

- Industry Trends: Changes in the overall market landscape and competitive dynamics affect GGLL’s stock price.

- Macroeconomic Factors: Interest rate changes, inflation rates, and overall economic conditions impact investor behavior and investment decisions.

- Investor Sentiment: News, analyst ratings, and social media discussions affect investor confidence and trading activity.

Macroeconomic factors such as rising interest rates could negatively impact GGLL’s stock price by increasing borrowing costs and potentially slowing economic growth. Conversely, a period of low inflation could create a more favorable investment environment, potentially boosting the stock price. Company-specific events, like successful product launches or strategic acquisitions, tend to positively impact the stock price, while negative news (e.g., product recalls or lawsuits) often leads to declines.

GGLL Stock Price Valuation and Forecasting

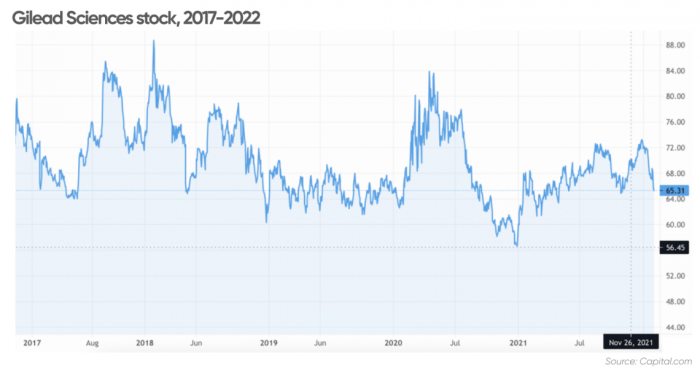

Source: capital.com

Various valuation methods can be used to estimate GGLL’s intrinsic value.

- Price-to-Earnings Ratio (P/E): Comparing GGLL’s price per share to its earnings per share provides a relative valuation metric.

- Discounted Cash Flow (DCF): Projecting future cash flows and discounting them back to present value offers a more comprehensive valuation.

The following table illustrates how different growth rate assumptions impact GGLL’s projected stock price (hypothetical scenario):

| Scenario | Growth Rate Assumption | Projected Price (USD) | Rationale |

|---|---|---|---|

| Conservative | 5% | 25.00 | Based on moderate revenue growth and stable market conditions. |

| Moderate | 10% | 30.00 | Assumes stronger revenue growth driven by successful new product launches. |

| Aggressive | 15% | 35.00 | Based on significant market share gains and rapid expansion into new markets. |

Potential risks include increased competition, economic downturns, and regulatory changes. Opportunities include expanding into new markets, developing innovative products, and strategic acquisitions.

GGLL Stock Price Investor Sentiment and News Analysis

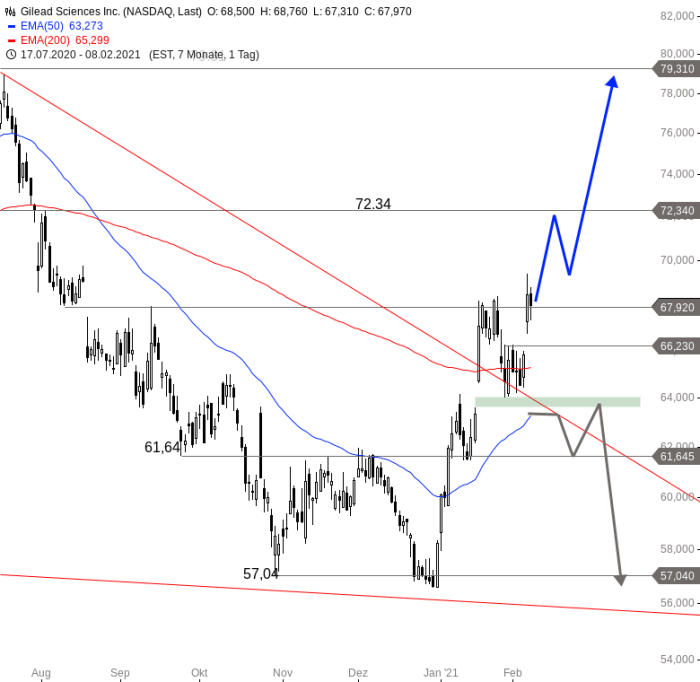

Source: godmode-trader.de

Recent news and analyst reports have influenced investor sentiment towards GGLL.

- Positive News: A recent positive earnings report resulted in a 5% price increase. Analyst upgrades also contributed to increased buying pressure.

- Negative News: Concerns about increasing competition led to a temporary price dip of 3%.

Currently, investor sentiment appears to be cautiously optimistic, with many analysts maintaining a “buy” or “hold” rating. Social media discussions often reflect this sentiment, though extreme opinions (both bullish and bearish) can temporarily influence short-term price movements.

GGLL Stock Price Technical Analysis

Technical indicators and chart patterns can provide insights into GGLL’s price trends.

- Moving Averages: A 50-day moving average crossing above a 200-day moving average could signal a bullish trend.

- Relative Strength Index (RSI): An RSI above 70 suggests the stock might be overbought, while an RSI below 30 suggests it might be oversold.

- Head and Shoulders Pattern: This chart pattern could indicate a potential price reversal.

Analyzing these indicators in conjunction with fundamental analysis provides a more comprehensive view of GGLL’s stock price outlook. It’s important to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Question Bank

What is the current GGLL stock price?

The current GGLL stock price is readily available through major financial websites and trading platforms. It fluctuates constantly, so checking a real-time source is essential.

Where can I find reliable GGLL stock information?

Reliable information can be found on reputable financial news sources, company investor relations websites, and SEC filings.

What are the major risks associated with investing in GGLL stock?

Risks include market volatility, industry competition, economic downturns, and company-specific factors such as management changes or operational challenges. A thorough risk assessment is crucial before investing.

Is GGLL a good long-term investment?

Whether GGLL is a suitable long-term investment depends on individual risk tolerance, investment goals, and a comprehensive analysis of the company’s financial health and future prospects. Consult with a financial advisor for personalized guidance.