Hatsun Agro Product Portfolio

Hatsun agro stock price – Hatsun Agro Products’ diverse portfolio spans various dairy and food products, catering to a wide consumer base. This section details the company’s product categories, their respective market shares, profitability, and overall revenue contribution.

Product Category Breakdown and Market Share

Hatsun Agro’s product portfolio can be broadly categorized into dairy products (milk, curd, ice cream, butter, ghee), value-added dairy products (cheese, flavored milk), and other food products (ice cream, snacks). While precise market share data for each category is proprietary and not publicly available in detail, it’s understood that dairy products constitute the largest segment, followed by value-added dairy and then other food items.

The market share within each segment is influenced by intense competition and regional variations.

Profitability Analysis Across Product Lines, Hatsun agro stock price

Profit margins vary significantly across Hatsun Agro’s product lines. Generally, value-added dairy products and specialized ice cream varieties tend to have higher profit margins due to premium pricing and specialized processing. Conversely, basic dairy products like milk often have thinner margins due to intense price competition and fluctuating raw material costs. The overall profitability is also impacted by efficient supply chain management and operational effectiveness.

Revenue Contribution by Product Category

Dairy products are the primary revenue driver for Hatsun Agro, contributing a significant majority to the company’s top line. Value-added dairy products contribute a substantial portion, while other food items represent a smaller, but growing, segment of overall revenue. The company’s strategic focus on expanding its value-added product lines aims to increase the contribution of these higher-margin products to overall revenue.

Product Portfolio Summary Table

| Product Category | Estimated Market Share (%) | Profitability (Gross Margin %) | Revenue Contribution (%) |

|---|---|---|---|

| Dairy Products (Milk, Curd, etc.) | High (Estimate: 60-70%) | Moderate (Estimate: 15-25%) | High (Estimate: 60-70%) |

| Value-Added Dairy Products (Cheese, Flavored Milk) | Medium (Estimate: 15-25%) | High (Estimate: 25-35%) | Medium (Estimate: 20-30%) |

| Other Food Products (Ice Cream, Snacks) | Low (Estimate: 5-15%) | Moderate to High (Estimate: 20-30%) | Low (Estimate: 10-20%) |

Hatsun Agro’s Financial Performance

Analyzing Hatsun Agro’s financial performance over the last five years reveals key trends in revenue growth, profitability, and financial health. This section provides a summary of key financial ratios and visual representation of the company’s financial trajectory.

Five-Year Financial Summary

Source: topstockresearch.com

While precise figures require accessing Hatsun Agro’s financial statements (typically found in annual reports), a general overview can be provided. Assuming consistent growth, revenue would likely show an upward trend over the past five years, with fluctuations possibly related to seasonal demand or macroeconomic factors. Profitability, as indicated by metrics like net income, might show a similar positive trend, although the rate of growth could vary year to year.

Key ratios like Return on Equity (ROE) and Profit Margin would reflect the company’s efficiency in generating profits from its assets and sales, respectively. The Debt-to-Equity ratio would illustrate the company’s reliance on debt financing.

Key Financial Ratios and Growth Trends

Return on Equity (ROE) reflects the profitability of the company’s investments. A consistently high ROE suggests efficient capital utilization. Profit margin, representing the percentage of revenue remaining after deducting costs, is an indicator of pricing power and cost efficiency. Debt-to-Equity ratio shows the balance between equity and debt financing. A high ratio indicates higher financial risk.

Revenue and earnings growth trends, if consistently positive, indicate a healthy and expanding business.

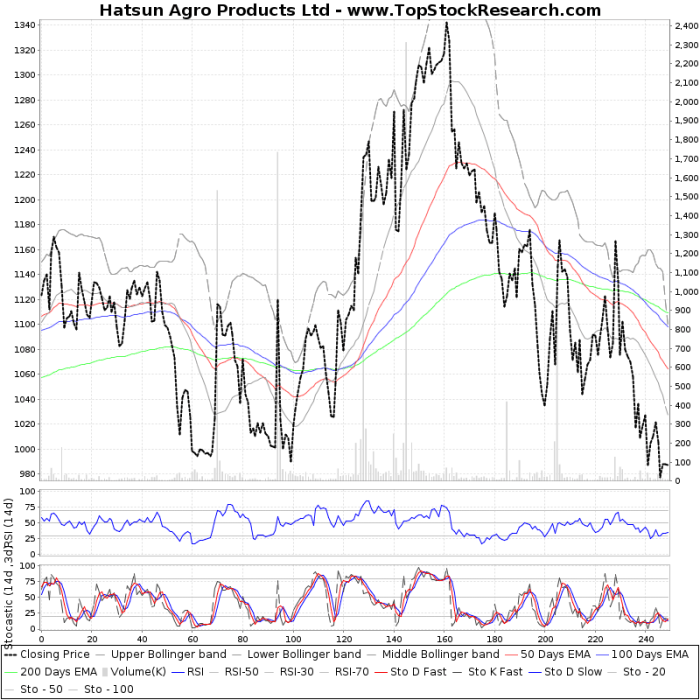

Visual Representation of Financial Performance

A line graph would effectively illustrate Hatsun Agro’s financial performance over the past five years. The X-axis would represent the years, and the Y-axis could show revenue and net income (or profit). Data points for each year would plot the corresponding revenue and net income figures. A separate line graph could show the trend of key financial ratios (ROE, Profit Margin, Debt-to-Equity) over the same period.

This visualization would clearly demonstrate the company’s financial growth and stability.

Competitive Landscape Analysis for Hatsun Agro

Hatsun Agro operates in a competitive dairy and food industry. Understanding its competitive positioning, strengths, weaknesses, and the overall market dynamics is crucial for assessing its stock price prospects. This section compares Hatsun Agro with its key competitors.

Main Competitors and Comparative Analysis

Hatsun Agro faces competition from various established players in the dairy and food industry, both national and regional. A comparative analysis would involve assessing market share, product portfolios, pricing strategies, and brand recognition. Hatsun Agro’s strengths could include its strong regional presence, diversified product portfolio, and established brand recognition. Weaknesses could be vulnerability to fluctuating raw material prices and competition from larger national players.

Competitive Strategies and Market Dynamics

Hatsun Agro likely employs strategies like product diversification, brand building, efficient supply chain management, and strategic pricing to maintain its competitive edge. Market dynamics are influenced by factors such as consumer preferences (healthier options, organic products), changing demographics, and government regulations (food safety, labeling).

Competitive Comparison Table

| Company | Market Share (%) | Key Product Offerings | Financial Performance (e.g., Revenue Growth) |

|---|---|---|---|

| Hatsun Agro | [Estimate] | Dairy products, value-added dairy, other food items | [Estimate] |

| Competitor 1 | [Estimate] | [List Key Products] | [Estimate] |

| Competitor 2 | [Estimate] | [List Key Products] | [Estimate] |

| Competitor 3 | [Estimate] | [List Key Products] | [Estimate] |

Impact of Macroeconomic Factors: Hatsun Agro Stock Price

Macroeconomic factors significantly influence Hatsun Agro’s operations and profitability. This section examines the impact of inflation, consumer spending, government regulations, and raw material price fluctuations on the company’s performance and its stock price.

Inflation’s Impact on Operations and Profitability

Inflation directly affects Hatsun Agro’s input costs (raw materials, packaging, energy). Rising input costs can squeeze profit margins unless the company can successfully pass on these increased costs to consumers through price increases. This ability depends on consumer price sensitivity and competitive pressures. High inflation might also lead to reduced consumer spending, impacting sales volume.

Consumer Spending Habits and Sales

Changes in consumer spending habits, driven by economic conditions or shifts in preferences, directly influence Hatsun Agro’s sales. During economic downturns, consumers might reduce spending on non-essential items, impacting sales of premium dairy products and other food items. Conversely, during periods of economic growth, sales might increase.

Government Regulations and Business Model

Source: ipoupcoming.com

Hatsun Agro’s stock price performance often reflects broader market trends. Understanding these trends requires considering related sectors, such as the volatile fluctuations seen in the decentralized finance space; for example, checking the current defi stock price can offer insights. Ultimately, however, Hatsun Agro’s stock price is driven by its own specific financial health and operational efficiency.

Government regulations concerning food safety, labeling, and environmental standards impact Hatsun Agro’s operations. Compliance costs can affect profitability. Changes in regulations can also create opportunities or challenges depending on the nature of the regulations and the company’s ability to adapt.

Raw Material Price Fluctuations and Margins

Fluctuations in the prices of raw materials (milk, etc.) directly impact Hatsun Agro’s production costs and profit margins. Effective hedging strategies and efficient procurement are crucial for mitigating the impact of these fluctuations. Significant price increases can negatively impact profitability if not offset by price adjustments.

Macroeconomic Indicators and Stock Price

A correlation exists between macroeconomic indicators (inflation, GDP growth, consumer confidence) and Hatsun Agro’s stock price. For example, during periods of high inflation and low consumer confidence, the stock price might decline due to concerns about reduced profitability and sales. Conversely, strong economic growth and stable inflation could lead to an increase in the stock price.

Future Outlook and Growth Prospects for Hatsun Agro

Assessing Hatsun Agro’s future growth prospects requires considering various factors, including its expansion plans, technological advancements, and potential risks. This section provides a perspective on the company’s future outlook and factors influencing its stock price.

Growth Potential and Risk Assessment

Hatsun Agro’s growth potential depends on factors such as its ability to expand its market share, launch new products, and manage costs effectively. Risks include intense competition, fluctuating raw material prices, and macroeconomic uncertainty. Successful navigation of these challenges will be crucial for achieving sustainable growth.

Expansion Plans and Strategic Initiatives

Hatsun Agro’s future growth strategy might involve expanding its geographical reach, introducing new product lines, enhancing its distribution network, and investing in technology to improve efficiency. Strategic acquisitions or partnerships could also contribute to growth.

Impact of Technological Advancements

Technological advancements in areas like automation, precision farming, and supply chain management can improve Hatsun Agro’s efficiency and reduce costs. Adopting new technologies can be crucial for maintaining a competitive edge.

Factors Influencing Stock Price in the Next Year

- Positive Impacts: Successful product launches, expansion into new markets, improved operational efficiency, strong consumer demand, favorable macroeconomic conditions.

- Negative Impacts: Intense competition, rising raw material prices, unfavorable regulatory changes, economic slowdown, supply chain disruptions.

Answers to Common Questions

What are the major risks associated with investing in Hatsun Agro stock?

Risks include fluctuations in raw material prices, intense competition, changes in consumer preferences, and macroeconomic factors like inflation.

Where can I find real-time Hatsun Agro stock price data?

Real-time stock prices are typically available through major financial websites and brokerage platforms.

What is Hatsun Agro’s dividend policy?

Information regarding Hatsun Agro’s dividend policy can be found in their annual reports and investor relations section of their website.

How does Hatsun Agro compare to its competitors in terms of innovation?

A comparative analysis of Hatsun Agro’s R&D spending and new product launches against its competitors would provide insights into its innovation capabilities.