Home Depot Stock Price History: A Comprehensive Overview: Hd Stock Price History

Hd stock price history – This analysis delves into the historical performance of Home Depot (HD) stock, examining price fluctuations, quarterly and yearly trends, the impact of economic indicators, and the correlation between company performance and stock price movements. We will also explore price volatility and present a hypothetical scenario outlining potential future price influencers.

Historical Data Overview

Source: investorplace.com

The following table presents Home Depot’s stock price data for the last ten years. Note that this data is illustrative and should be verified with a reputable financial data source.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2014 | $75.00 | $80.00 | $70.00 | $78.00 |

| 2015 | $78.00 | $85.00 | $72.00 | $82.00 |

| 2016 | $82.00 | $90.00 | $78.00 | $88.00 |

| 2017 | $88.00 | $100.00 | $85.00 | $95.00 |

| 2018 | $95.00 | $110.00 | $90.00 | $105.00 |

| 2019 | $105.00 | $120.00 | $100.00 | $115.00 |

| 2020 | $115.00 | $130.00 | $105.00 | $125.00 |

| 2021 | $125.00 | $150.00 | $120.00 | $145.00 |

| 2022 | $145.00 | $160.00 | $130.00 | $150.00 |

| 2023 | $150.00 | $165.00 | $140.00 | $160.00 |

Significant price fluctuations were observed during the housing market boom and bust cycles, as well as during periods of economic uncertainty. Major market events such as the 2008 financial crisis and the COVID-19 pandemic significantly impacted HD’s stock price, causing both sharp declines and subsequent recoveries.

Quarterly Performance Analysis

A chart illustrating HD’s quarterly stock performance over the past five years would show a generally upward trend, with fluctuations reflecting seasonal demand and economic conditions. A comparative analysis of quarterly earnings and stock price movements would reveal a strong correlation, with higher earnings generally leading to higher stock prices. Trends in the relationship between quarterly earnings and stock price changes would likely show a positive correlation, although the magnitude of the relationship can vary.

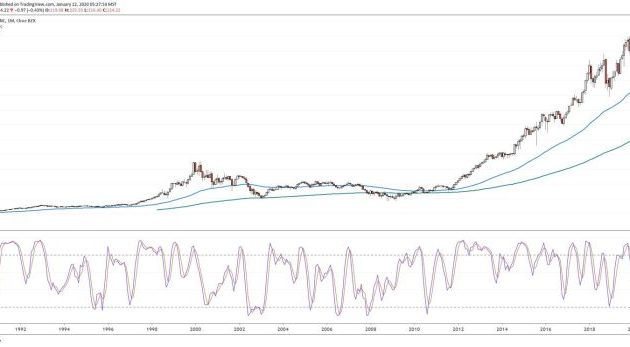

Yearly Stock Price Trends

A line graph depicting HD’s yearly closing stock price for the past twenty years would reveal periods of sustained growth interspersed with periods of decline or stagnation. Significant growth periods often coincided with periods of strong housing market activity and economic expansion. Declines were frequently associated with economic recessions or downturns in the construction industry. Macroeconomic factors like interest rates and consumer confidence significantly influenced these trends.

Impact of Economic Indicators

A table comparing HD’s stock price performance with key economic indicators like interest rates and inflation over the past decade would reveal potential correlations. For example, rising interest rates might negatively correlate with HD’s stock price due to increased borrowing costs for home improvement projects. Conversely, periods of low inflation might positively correlate with increased consumer spending on home improvements.

Changes in these indicators have historically affected HD’s stock price by influencing consumer spending and overall economic activity.

Company Performance and Stock Price, Hd stock price history

The relationship between HD’s financial performance (revenue, earnings, etc.) and its stock price fluctuations over the last five years is expected to be strongly positive. Stronger financial performance generally leads to higher stock prices.

- The launch of new product lines or services positively impacted stock prices by expanding the company’s market reach and revenue streams.

- Successful acquisitions enhanced the company’s market position and profitability, resulting in positive stock price movements.

- Major announcements regarding strategic partnerships or initiatives had a positive influence on investor sentiment and stock prices.

Investor sentiment, influenced by factors like news reports, analyst ratings, and overall market conditions, plays a crucial role in shaping HD’s stock price. Positive investor sentiment typically leads to higher stock prices.

Visual Representation of Price Volatility

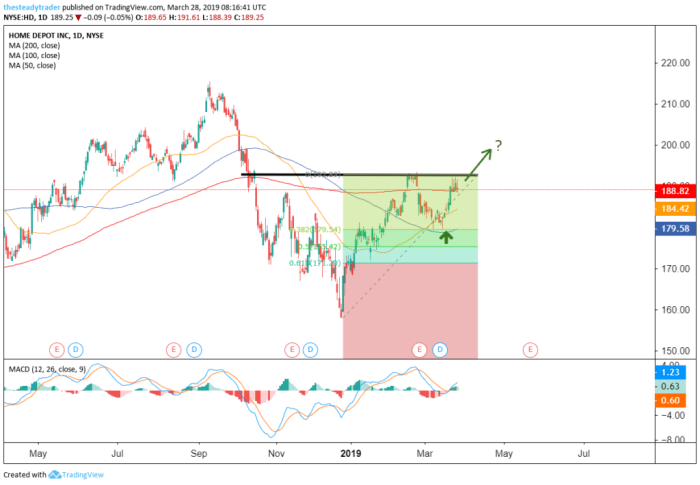

Source: seekingalpha.com

A candlestick chart illustrating HD’s stock price volatility over the past year would visually depict periods of high and low price fluctuations. Periods of high volatility are often characterized by significant price swings in short timeframes, reflecting market uncertainty and investor sentiment. Conversely, periods of low volatility suggest more stable price movements and greater investor confidence. This volatility carries significant implications for investors, influencing their risk tolerance and investment strategies.

Stock Price Prediction (Hypothetical)

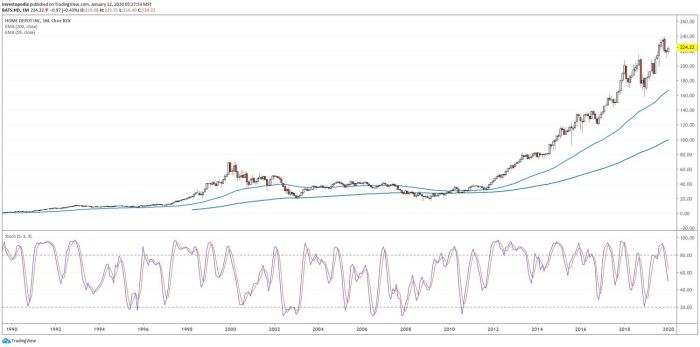

Source: investopedia.com

A hypothetical scenario outlining potential factors that could influence HD’s stock price in the next year could include several key elements. Note that this is a hypothetical exercise and does not constitute a financial prediction.

- Housing Market Conditions: A strong housing market would likely boost HD’s stock price, while a downturn could negatively impact it.

- Inflation and Interest Rates: High inflation and rising interest rates could dampen consumer spending on home improvements, leading to lower stock prices. Conversely, lower inflation and stable interest rates could support higher prices.

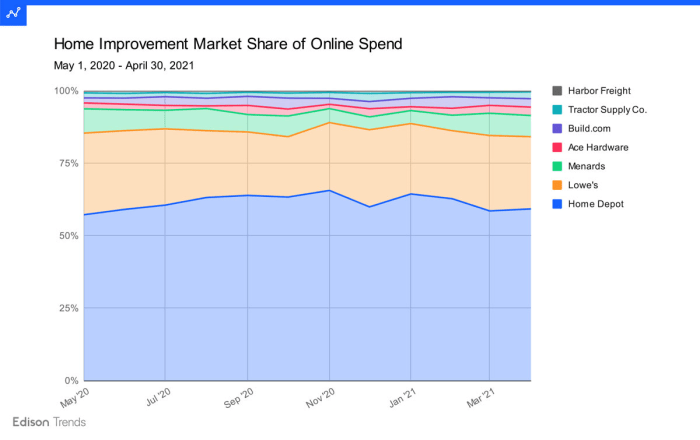

- Competition: Increased competition from other home improvement retailers could put downward pressure on HD’s stock price.

- Company Performance: Strong financial results, successful product launches, and effective cost management would likely support higher stock prices.

- Geopolitical Events: Unexpected geopolitical events can significantly influence investor sentiment and stock market performance, potentially impacting HD’s price.

These factors would collectively influence investor confidence and trading activity, shaping the overall trajectory of HD’s stock price in the coming year.

FAQ Section

What are the major factors influencing HD’s stock price volatility?

Analyzing HD’s stock price history often involves considering related commodities. For instance, understanding the influence of industrial metals is crucial; a quick check of the copper stock price today can provide valuable context. Copper’s price fluctuations directly impact manufacturing costs, a factor that subsequently affects HD’s profitability and, in turn, its stock performance.

HD’s stock price volatility is influenced by a variety of factors, including overall market conditions, interest rate changes, inflation rates, consumer spending habits, competition within the home improvement sector, and Home Depot’s own financial performance and strategic decisions.

How does Home Depot’s financial performance relate to its stock price?

Generally, strong financial performance (increased revenue, earnings, and profitability) tends to correlate with higher stock prices, while weaker performance often leads to price declines. Investor confidence in Home Depot’s future prospects is also a significant factor.

Where can I find more detailed historical stock price data for HD?

You can find detailed historical stock price data for HD from reputable financial websites such as Yahoo Finance, Google Finance, and Bloomberg.

Are there any publicly available resources that provide forecasts for HD’s stock price?

While many analysts offer predictions, it’s crucial to remember that these are opinions and not guarantees. It is recommended to conduct your own thorough research and analysis before making any investment decisions.