How I Slashed My Health Insurance Costs Without Losing Coverage

I used to dread opening my health insurance bill—until I realized I was overpaying for coverage I didn’t fully understand. After years of confusion and surprise medical bills, I took a closer look at my plan and made smart, legal tweaks that cut my monthly costs significantly. This isn’t about skipping care or risking coverage—it’s about working the system the right way. I learned how to align my plan with my actual health needs, avoid hidden fees, and take advantage of tax-saving tools most people overlook. If you’re tired of feeling ripped off by insurance, what I discovered might change everything for you. With a little knowledge and careful planning, it’s possible to keep excellent coverage while freeing up hundreds—or even thousands—of dollars each year.

The Hidden Trap in Your Health Insurance Plan

Many people assume their employer-chosen or government-subsidized health insurance plan is automatically the best fit, but that assumption can be costly. The reality is that default plans are designed for broad appeal, not personal efficiency. They often come with high premiums, complex deductibles, and out-of-network risks that can quietly drain your finances. These plans may include benefits you don’t need—like extensive maternity services or rare specialty care—while failing to cover routine services you actually use. Without understanding the structure of your policy, you’re likely overpaying for underused features and underprotected where it matters most.

One of the most overlooked aspects of health insurance is the distinction between premiums, deductibles, copays, and out-of-pocket maximums. Your premium is the monthly fee you pay to maintain coverage, regardless of whether you use medical services. The deductible is the amount you must pay out of pocket before your insurance begins to cover most services. Copays are fixed fees you pay at the time of service, such as $20 for a doctor’s visit. The out-of-pocket maximum is the most you’ll ever pay in a year—after reaching this limit, your insurance covers 100% of eligible costs. Misunderstanding these terms can lead to poor plan choices and unexpected bills.

For example, a plan with a low monthly premium might seem attractive, but if it has a high deductible and limited network access, a single emergency visit could result in thousands of dollars in charges. Conversely, a higher-premium plan might offer lower deductibles and broader coverage, making it more cost-effective if you have regular medical needs. The key is not to judge a plan by its monthly price tag alone, but to evaluate how its structure matches your health usage. By reviewing past medical expenses, prescription needs, and anticipated procedures, I was able to identify where my old plan was inefficient and where I could make smarter choices.

This realization was a turning point. I stopped viewing insurance as a fixed expense and started treating it as a customizable financial tool. I began comparing plans not just by cost, but by value—how much protection I actually received for what I paid. This shift in mindset allowed me to see opportunities for savings that had been invisible before. It wasn’t about cutting corners; it was about making informed decisions that aligned with my real-life health patterns and financial goals.

Why "More Coverage" Isn’t Always Better

There’s a common belief that more comprehensive health insurance means better protection. While it sounds logical, this mindset often leads to overbuying—paying for extensive benefits that you may never use. Insurance companies bundle services to make plans appear more valuable, but those extra features come at a price. Premiums rise to cover the cost of maternity care, fertility treatments, pediatric dental, or international emergency coverage—services that may have little relevance to your life. If you’re a healthy adult with no plans for children, for instance, paying extra for maternity benefits doesn’t make financial sense.

I used to think I needed the most complete plan available, fearing that any gap in coverage could leave me vulnerable. But after reviewing my medical history over the past five years, I realized I rarely used more than basic services: annual checkups, prescription medications, and the occasional specialist visit. I wasn’t getting MRIs, surgeries, or hospital stays. Yet my plan was priced as if I were a high-utilization patient. This mismatch between my actual needs and my coverage level meant I was subsidizing services I didn’t use—essentially paying for someone else’s care.

By switching to a plan that focused on preventive care, generic drug coverage, and access to in-network providers, I was able to reduce my premium by nearly 30%. I didn’t lose essential protection; I simply eliminated the excess. This wasn’t a downgrade—it was a realignment. I still had access to emergency care, hospitalization, and chronic disease management, but I no longer paid for niche benefits that didn’t apply to me. The money I saved each month was redirected into a dedicated health savings account, creating a financial cushion for future needs.

This approach requires honest self-assessment. Ask yourself: How often do I see a doctor? Do I take regular medications? Am I managing a chronic condition? Are there upcoming procedures or tests? Answering these questions helps determine whether you truly need a platinum-level plan or if a bronze or silver option would serve you just as well. For many families, especially those in good health, a leaner, more targeted plan offers better value. It’s not about sacrificing security—it’s about spending wisely and avoiding unnecessary costs.

Choosing the Right Deductible: Balancing Risk and Savings

One of the most impactful decisions in health insurance is selecting the right deductible level. This choice directly affects both your monthly premium and your potential out-of-pocket costs. A low-deductible plan typically comes with a higher monthly payment but requires less upfront spending when you receive care. A high-deductible plan, on the other hand, lowers your premium but means you pay more before insurance kicks in. The key is finding the balance that fits your health profile and financial stability.

For years, I avoided high-deductible health plans (HDHPs) out of fear. I worried that if an unexpected illness or injury occurred, I wouldn’t be able to cover the initial costs. But after analyzing my family’s medical history and financial reserves, I realized our risk was relatively low. We didn’t have chronic conditions, frequent hospital visits, or ongoing treatments. We were healthy, proactive about prevention, and had a modest emergency fund. With that in mind, switching to an HDHP became a logical step—one that immediately reduced our monthly premium by over $200.

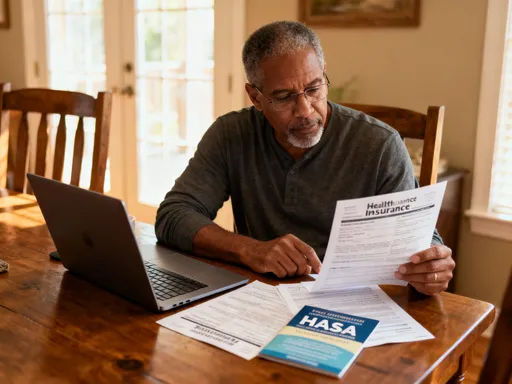

What made this switch even more effective was pairing the HDHP with a Health Savings Account (HSA). This combination is one of the most powerful tools available for managing health care costs. The HSA allows you to contribute pre-tax dollars to a savings account specifically for medical expenses. Those funds can be used tax-free for qualified costs like doctor visits, prescriptions, dental care, and even some over-the-counter medications with a prescription. Unlike flexible spending accounts (FSAs), HSA funds roll over year after year and remain yours even if you change jobs or retire.

By contributing regularly to my HSA, I built a dedicated pool of money to cover my deductible if needed. This eliminated the fear of high out-of-pocket costs and gave me greater control over my spending. In years when we didn’t use all the funds, the balance continued to grow—some accounts even offer interest or investment options, allowing the money to compound over time. The tax advantages are significant: contributions reduce your taxable income, earnings grow tax-free, and withdrawals for medical purposes are also tax-free. Few financial vehicles offer this triple tax benefit, making the HDHP-HSA combination a smart strategy for long-term financial health.

Maximizing the Power of Health Savings Accounts (HSAs)

Despite their benefits, Health Savings Accounts remain underutilized by many Americans. Most people see them as simple medical savings tools, but they are far more powerful than that. An HSA is not just a way to pay for doctor visits—it’s a strategic financial asset that can enhance both short-term affordability and long-term wealth building. When used wisely, it becomes a cornerstone of a smarter, more resilient financial plan.

I started contributing to my HSA as soon as I enrolled in a qualified HDHP. At first, I used the funds to cover routine expenses like annual physicals and prescription refills. But over time, I adopted a more strategic approach: I began paying smaller medical bills out of pocket and leaving my HSA balance untouched. By doing so, I allowed the account to grow while preserving the option to reimburse myself later—tax-free—for any qualified expense, even years after it was incurred. This flexibility is unique to HSAs and provides a level of financial control that other accounts don’t offer.

Another advantage is the investment potential. Once your HSA balance reaches a certain threshold—typically $1,000 to $2,000, depending on the provider—you can often invest the funds in mutual funds, ETFs, or other low-cost options. This transforms the account into a long-term growth vehicle. I began investing a portion of my HSA, treating it like a supplemental retirement account. The returns aren’t guaranteed, but over time, even modest growth can significantly increase the value of the fund. By retirement, my HSA could cover a substantial portion of my health care costs without touching my other savings.

Perhaps the most compelling feature is the tax efficiency. Contributions are made with pre-tax dollars, reducing your adjusted gross income. The money grows tax-free, and withdrawals for qualified medical expenses are also tax-free. This triple tax advantage is unmatched by any other savings or investment account. Even if you don’t need the funds immediately, keeping them in the HSA preserves these benefits indefinitely. After age 65, you can withdraw the money for any purpose without penalty—though non-medical withdrawals are taxed as income. For many, this makes the HSA a stealth retirement account, offering both health and financial security.

Avoiding Out-of-Network Surprises That Inflate Bills

One of the most frustrating experiences in health care is receiving a surprise bill for services you thought were covered. This often happens due to out-of-network charges—even when you visit an in-network hospital or doctor. A common scenario: you schedule a test at an in-network facility, but the radiologist or lab technician who processes your results is out of network. Because you didn’t directly choose that provider, you may be billed at a much higher rate, with little recourse.

I learned this the hard way after a routine MRI. The imaging center was in my network, and I confirmed coverage beforehand. But weeks later, I received a $1,200 bill from an out-of-network billing company that had interpreted the scan. My insurance paid only a fraction, leaving me responsible for the rest. This type of balance billing can turn a simple procedure into a financial shock. Since then, I’ve adopted a more proactive approach to verifying every aspect of my care.

Now, before any procedure, I call my insurance provider to confirm that all involved parties—doctors, technicians, labs, and facilities—are in network. I ask specifically about ancillary services and request written confirmation if possible. I also use online price transparency tools offered by my insurer or third-party platforms to compare costs across providers. These tools allow me to see not just the list price, but the negotiated rate my insurance has secured. In several cases, I’ve found the same service available at a different location for hundreds of dollars less—without sacrificing quality.

I’ve also learned to ask about facility fees, which can significantly increase the total cost. Some hospitals charge separate fees for using their equipment or infrastructure, even if the doctor is in network. By choosing freestanding clinics or outpatient centers when appropriate, I’ve avoided these extra charges. Being vigilant has not only saved me money but also reduced stress. I no longer fear the unknown; instead, I approach medical care with the same diligence I apply to other major financial decisions.

Timing Medical Expenses Strategically

Health spending doesn’t have to be random or reactive. Just as you plan for taxes, vacations, or home repairs, you can—and should—plan your medical expenses. By timing non-urgent procedures, screenings, and prescription renewals around your deductible cycle, you can maximize insurance benefits and minimize out-of-pocket costs. This approach turns health care into a predictable part of your budget rather than a series of financial surprises.

My deductible resets every January, so I now plan accordingly. In the fall, I review my health status and consult with my doctor about any upcoming needs—mammograms, blood work, dental cleanings, or elective procedures. If possible, I schedule these services in December, so the expenses count toward the current year’s deductible. Once I’ve met my deductible, I can access covered services at little or no cost for the remainder of the year. This strategy ensures I get the most value from my plan while avoiding unnecessary out-of-pocket spending.

I also coordinate prescription refills to align with my deductible status. If I’m close to meeting my limit, I’ll refill a 90-day supply to push the total over the threshold, ensuring that future prescriptions are fully covered. For medications with fluctuating prices, I check for discounts and mail-order options that offer better rates. Some pharmacies even have loyalty programs or price-matching policies that can reduce costs further.

This kind of planning requires a bit of organization, but the payoff is significant. Over the past three years, strategic timing has saved me an average of $800 annually. It’s not about delaying necessary care—it’s about optimizing when you receive it. Like financial planning, it’s about making intentional choices that protect your health and your wallet. When you treat medical spending as part of your overall budget, you gain control and confidence.

When to Switch Plans—and When to Stay Put

Annual enrollment isn’t just a paperwork exercise—it’s a critical opportunity to reassess your health insurance needs. Too many people accept their current plan automatically, assuming that change is risky or complicated. But staying with a plan that no longer fits your life can cost you money and limit your access to care. Each year, I review every available option, comparing premiums, deductibles, provider networks, and drug formularies to ensure my coverage still aligns with my needs.

There are clear red flags that signal it’s time to switch. A sudden premium increase with no added benefits is a major warning sign. So is a shrinking provider network—if your doctor or preferred hospital is no longer in the plan, your access to care is compromised. Changes in prescription drug coverage can also be disruptive. If a medication you rely on is moved to a higher tier or removed from the formulary, your out-of-pocket costs could rise dramatically. These changes often go unnoticed until you’re faced with a bill, so proactive review is essential.

At the same time, there are situations where staying put makes sense. If you’re in the middle of a treatment plan, such as physical therapy, chemotherapy, or fertility care, switching mid-cycle could disrupt continuity and lead to delays. Some plans have prior authorization requirements or different coverage rules that could affect your care. If you’re satisfied with your current doctors, medications, and level of coverage, and there are no significant cost increases, it may be wise to maintain stability.

The key is to make an informed decision, not an automatic one. I gather all the plan documents, use comparison tools, and sometimes consult a benefits advisor to understand the full picture. This annual review has helped me avoid costly mistakes and identify better options. In one year, switching to a new silver-level plan saved me $1,400 annually while offering broader specialist access. In another, I stayed with my current plan because it included a rare medication I depend on. Either way, the choice was intentional—not passive.

Taking Control of Your Health and Wealth

Optimizing health insurance isn’t about cutting corners—it’s about making intentional choices that protect both your body and your budget. By rethinking coverage, leveraging HSAs, and planning strategically, I’ve turned a confusing expense into a manageable, even empowering, part of my financial life. You don’t need a finance degree to save money on healthcare; you just need the right mindset and a willingness to ask questions. When you understand how the system works, you stop paying too much—and start gaining real control.

The journey began with frustration, but it led to confidence. I no longer feel helpless when opening my insurance statement. I know my options, understand my benefits, and make decisions based on data, not fear. The savings I’ve achieved haven’t come from risk-taking or sacrificing care—they’ve come from clarity, discipline, and smart planning. And the benefits extend beyond money: I feel more secure, more informed, and more in charge of my well-being.

Health insurance will never be simple, but it doesn’t have to be overwhelming. With a little effort and the right strategies, you can design a plan that fits your life, protects your family, and supports your financial goals. The system isn’t perfect, but it rewards those who pay attention. By taking the time to understand your coverage, you gain more than savings—you gain peace of mind. And that’s a benefit worth every effort.